Build Your Credit the Smart Way

Modern credit solutions built for consistent, repeatable results.

Consumer Law Letters

Our Consumer Law Letters process is designed to deliver fast, factual, and effective credit dispute results. Within 48 hours, we generate and send 6-9 targeted dispute letters on behalf of the client.

FCRA Compliance

The three credit bureaus must follow the Fair Credit Reporting Act (FCRA). FCRA is consumer law and is the method used for our disputes.

Factual Disputing

Factual disputing focuses on breaking down reporting inaccuracies. We identify and challenge errors that don't comply with reporting standards.

Categorized Disputes

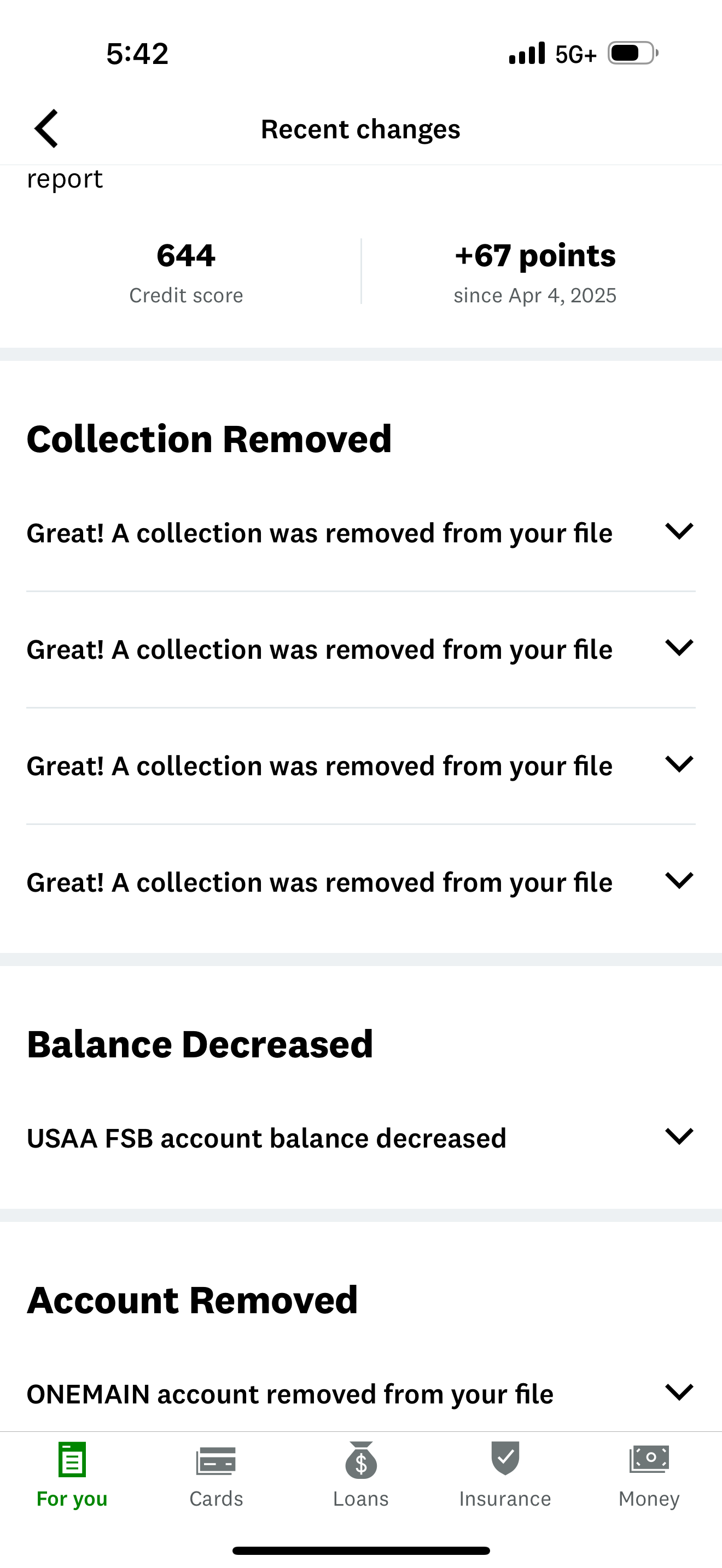

Disputes are separated by category (collections, public information, late payments) for maximum efficiency and effectiveness.

How Our Credit Dispute Process Works

A systematic approach to restoring your credit

Targeted Dispute Letters (6-9 per cycle)

Letters are generated within 48 hours. Disputes are factual, categorized, and submitted under FCRA standards to force proper investigations.

Direct Experian Upload (Metro-2)

Metro-2 dispute letters are uploaded directly through Experian's online disputing portal. Metro-2 is the internal reporting language used by bureaus, increasing documentation accuracy and accountability.

CFPB Complaints

Complaints are filed with the Consumer Financial Protection Bureau when investigations fail, triggering mandatory responses using the Metro-2 format.

BBB Complaints

Formal complaints are submitted to the Better Business Bureau when inaccurate reporting persists, creating public compliance records to support resolution.

Legal Review & Litigation Support

Consumer law attorneys review full credit reports to identify violations, including illegal stall tactics. Clients may qualify for statutory damages between $1,000 and $2,500 depending on case strength.

What Clients Can Expect

- Initial movement within 40-60 days

- Ongoing updates throughout the dispute process

- Outcomes dependent on creditor responses

- Professional guidance at every step

Ideal Clients

- Homebuyers preparing for mortgage qualification

- Consumers addressing collections or late payments

- Individuals seeking lawful, structured dispute handling

Important Notes

No results are guaranteed. This is not legal advice. Timelines vary by individual profile. Attorney involvement is case-by-case and independent.

Credit Bureau Logos

We work with all three major bureaus:

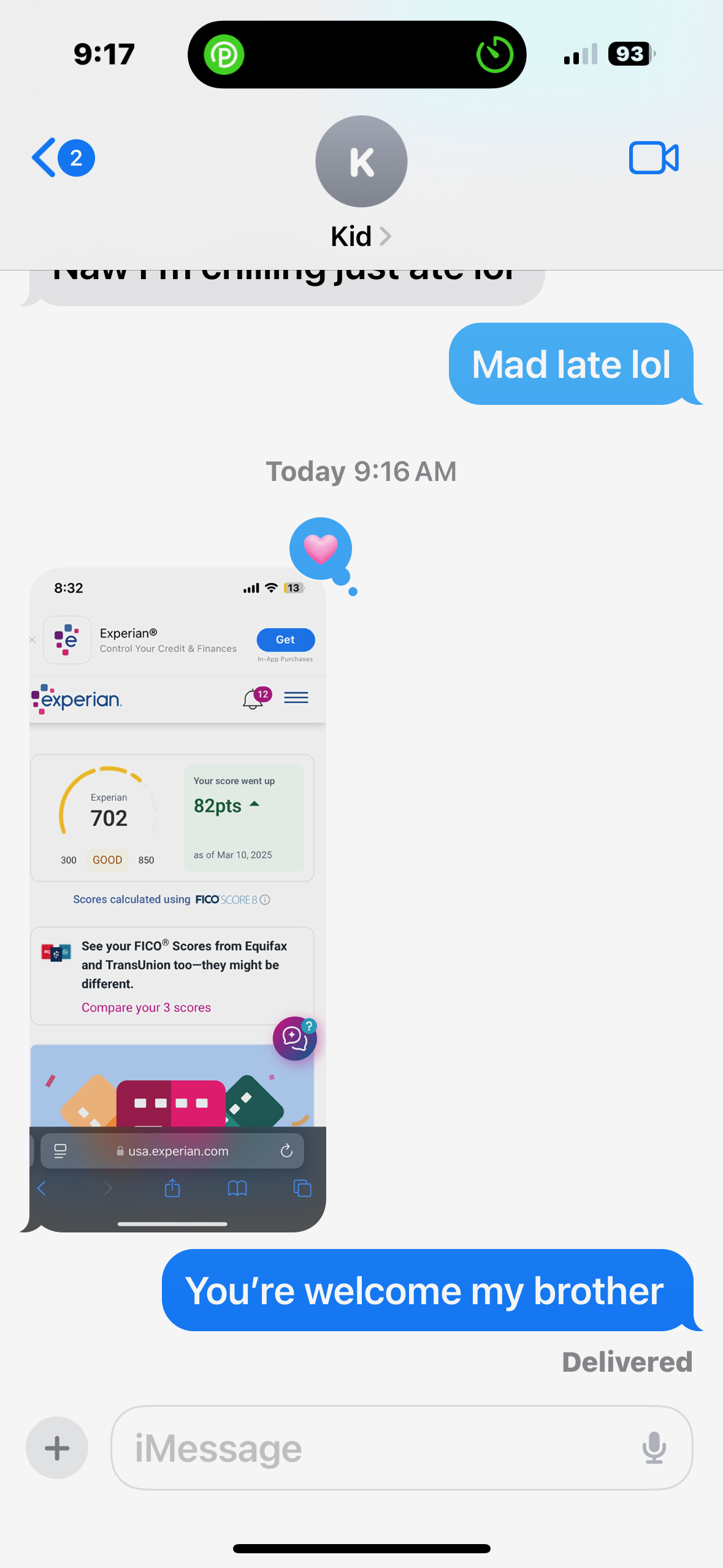

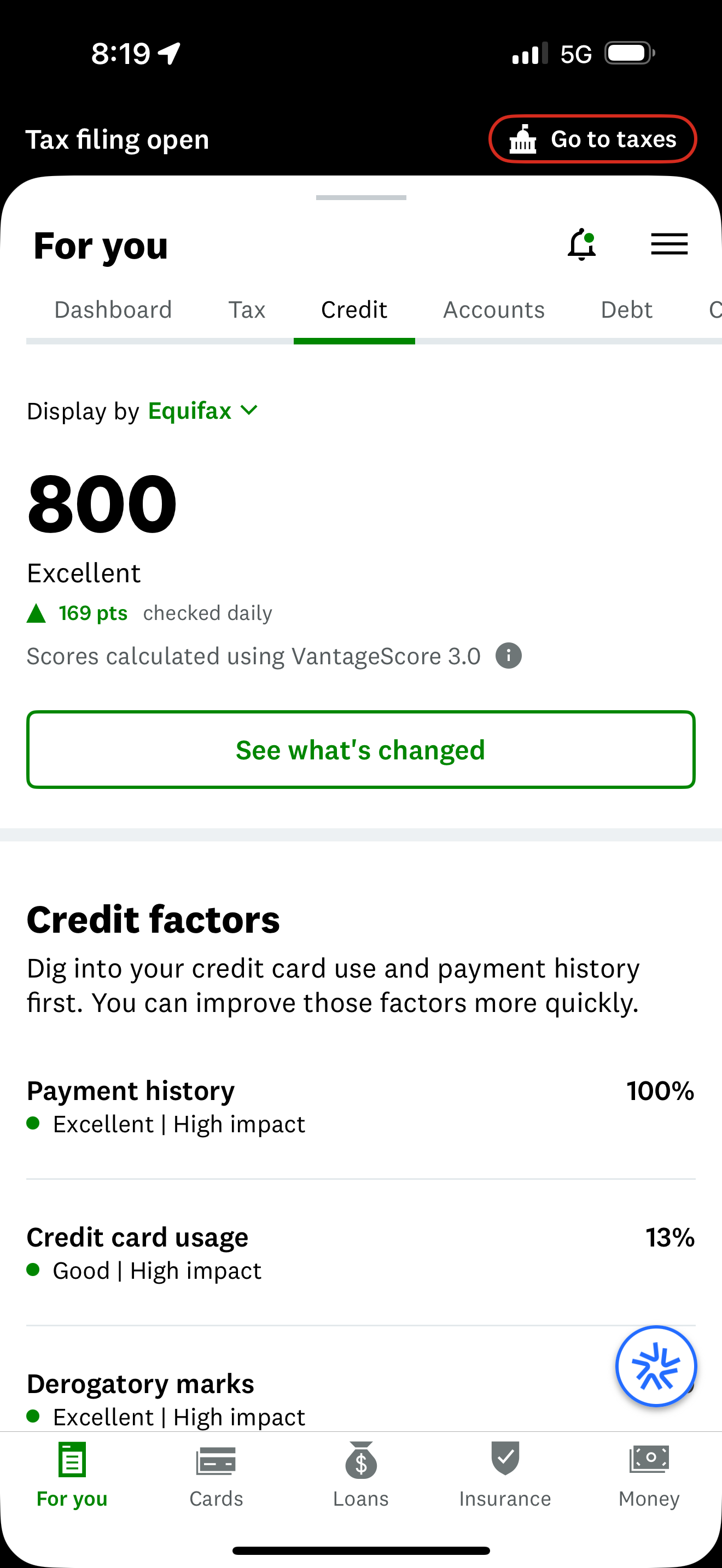

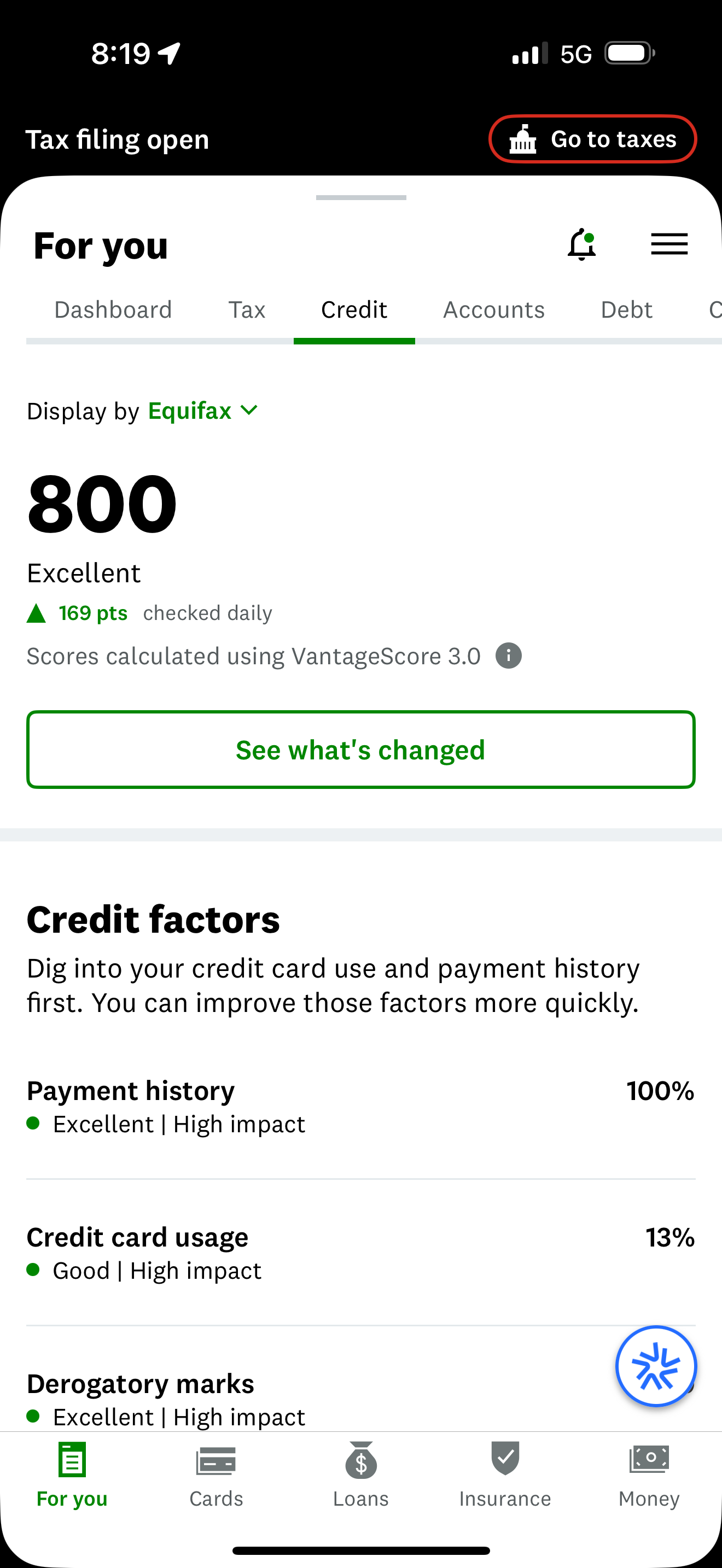

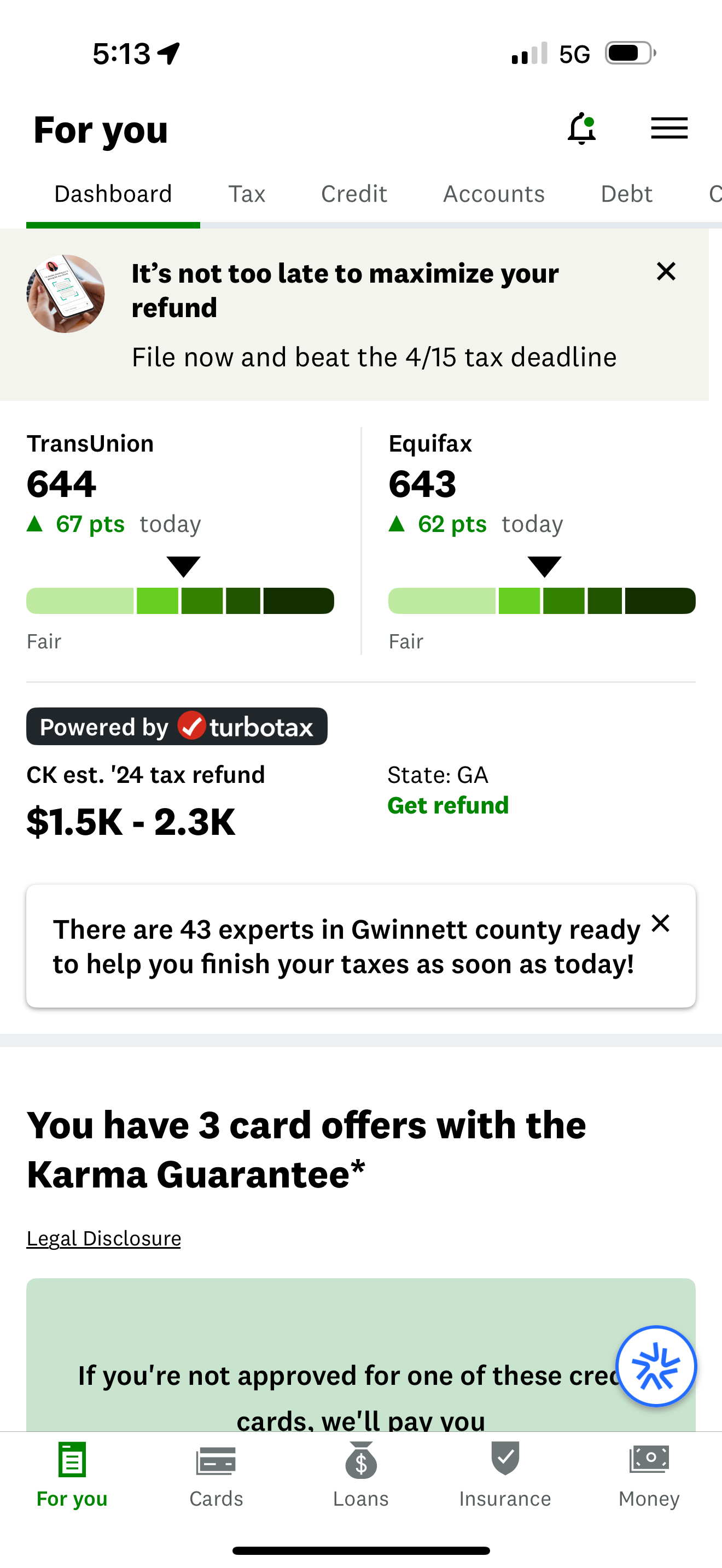

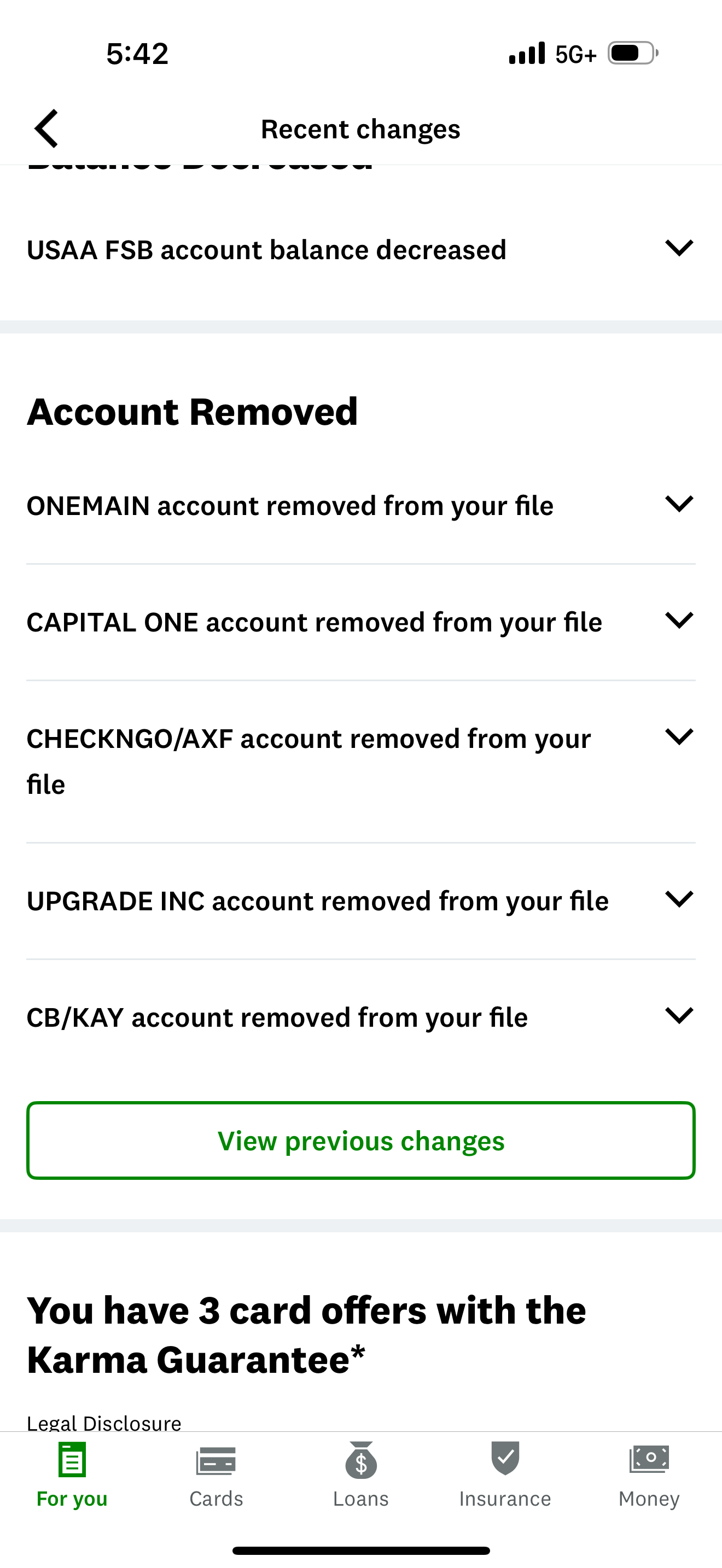

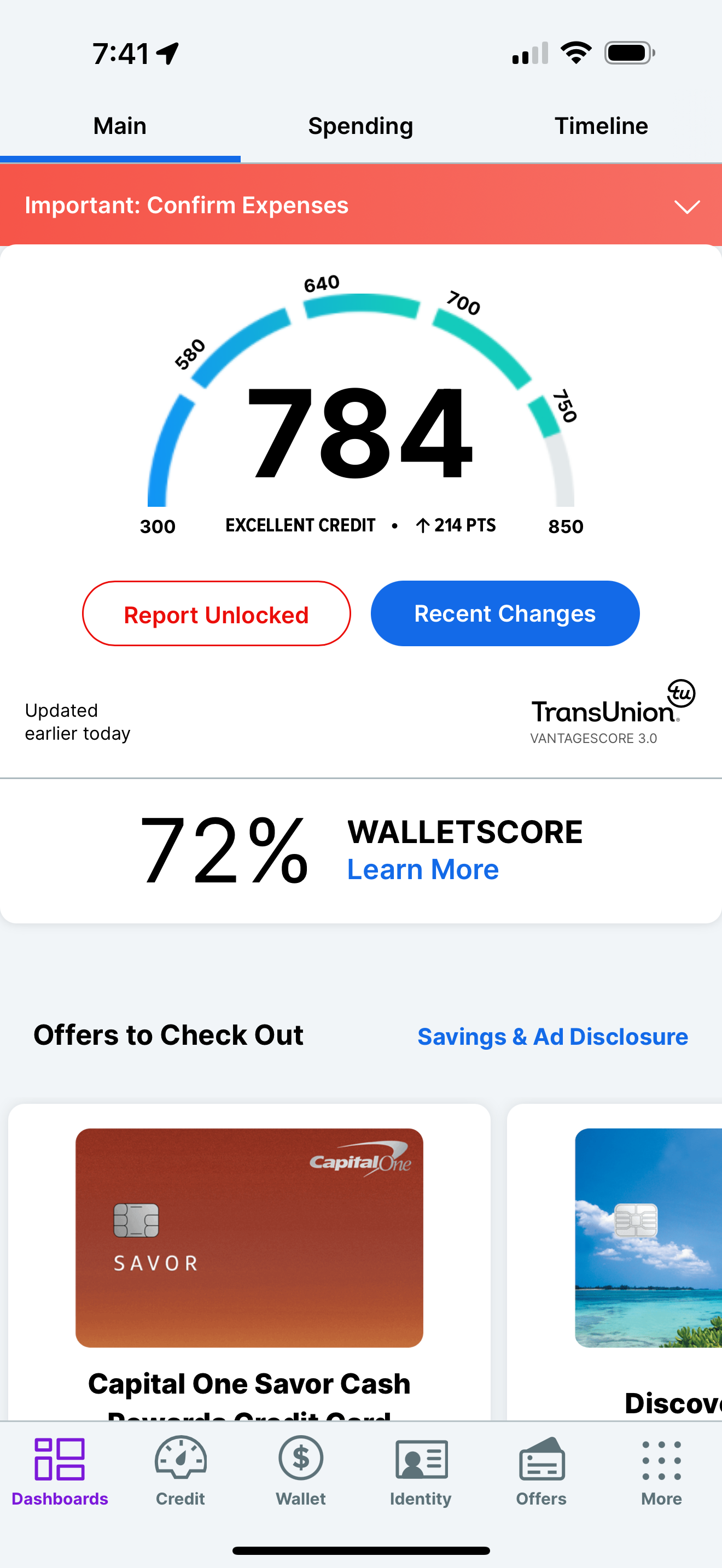

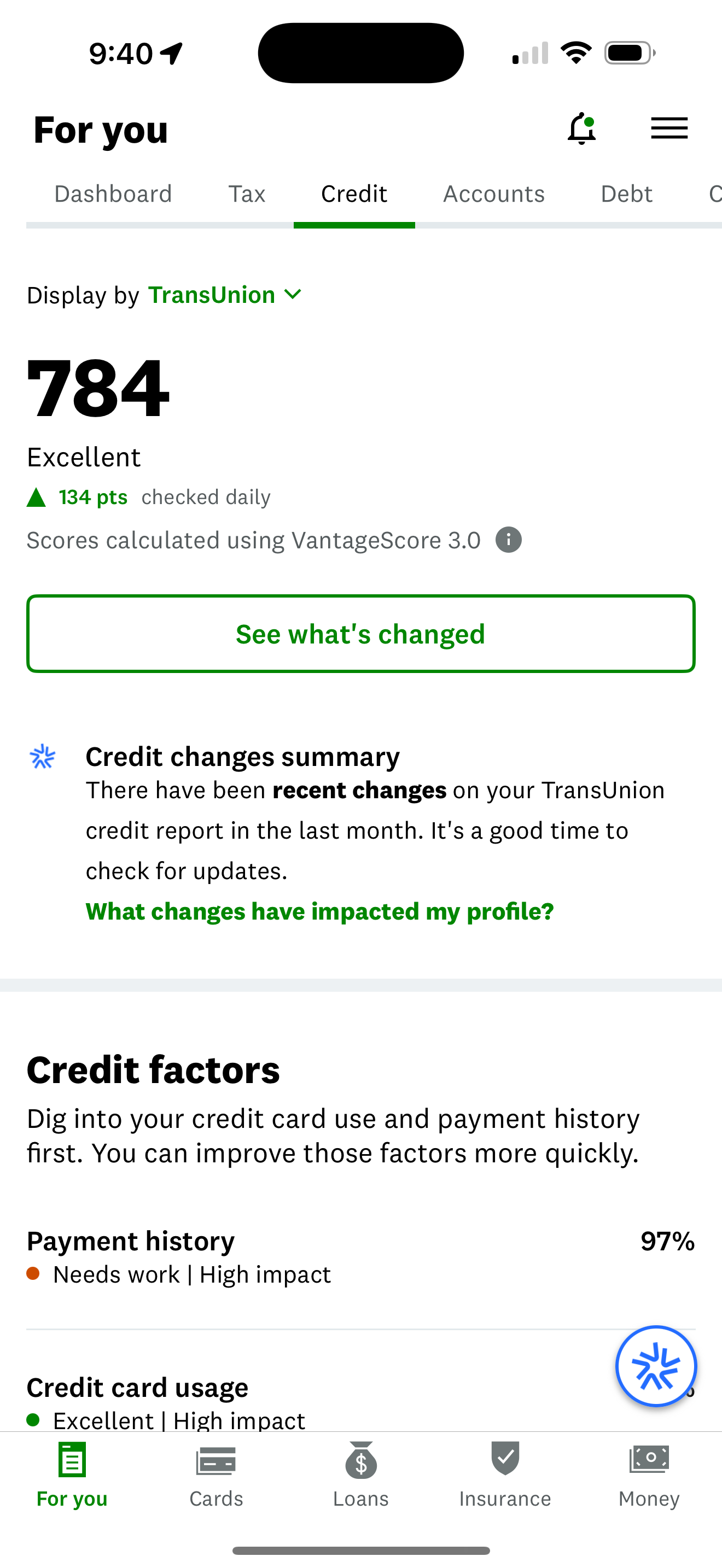

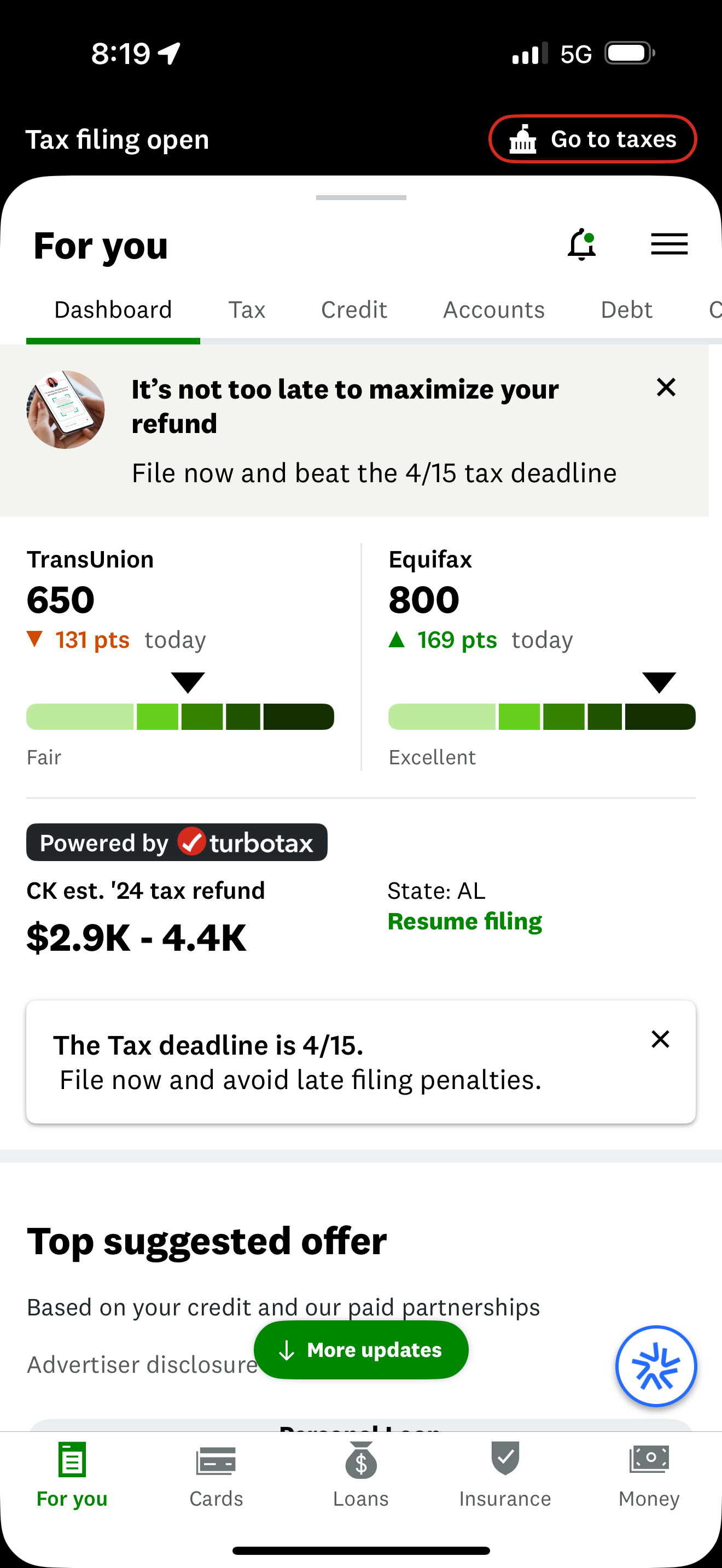

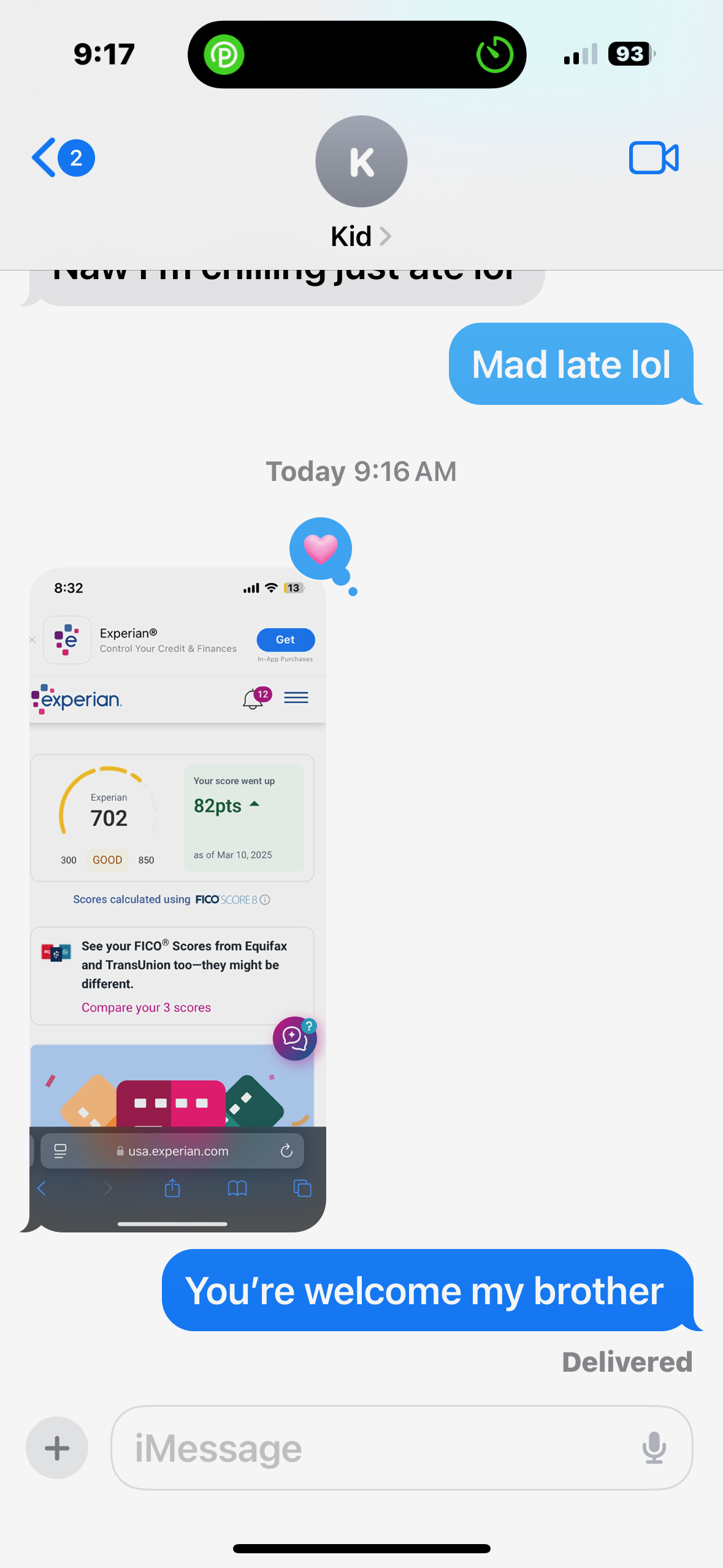

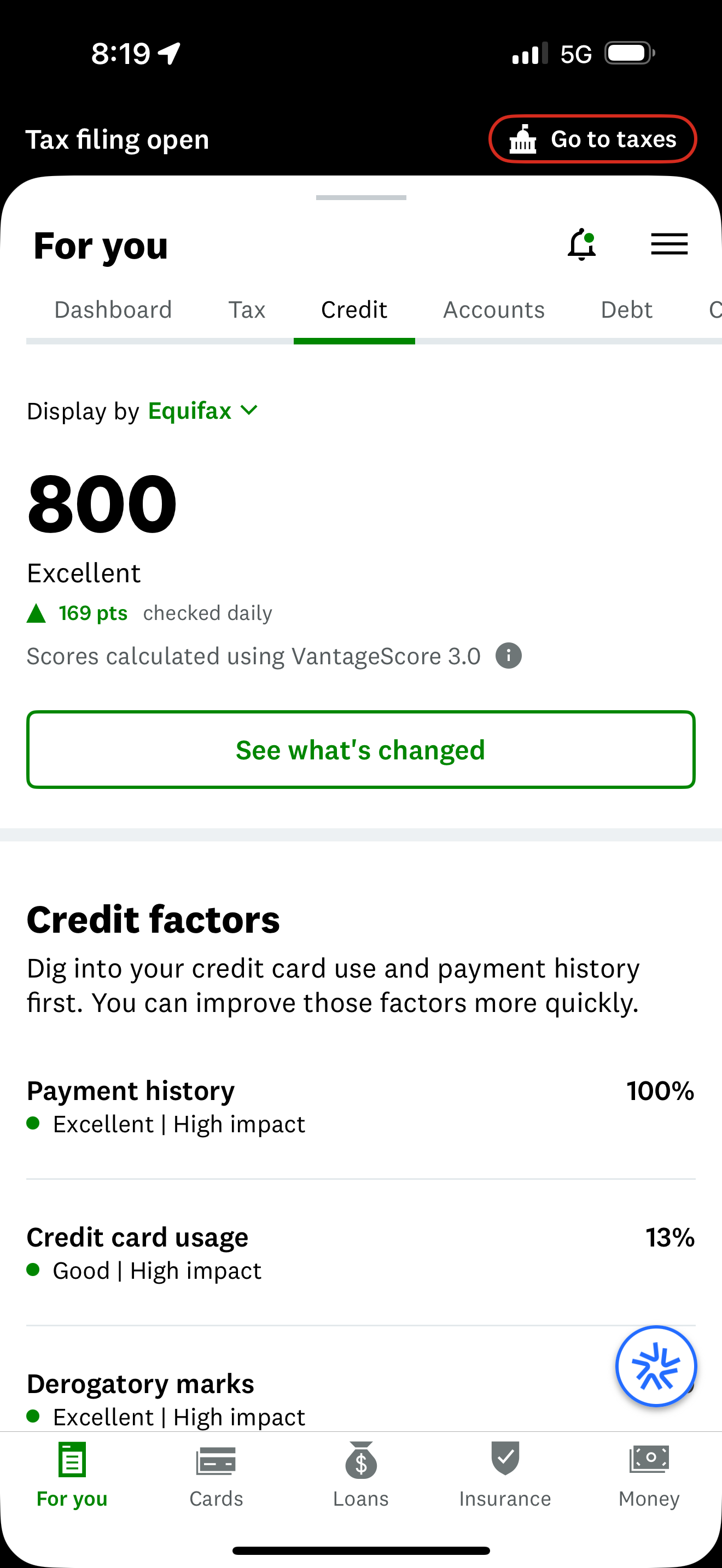

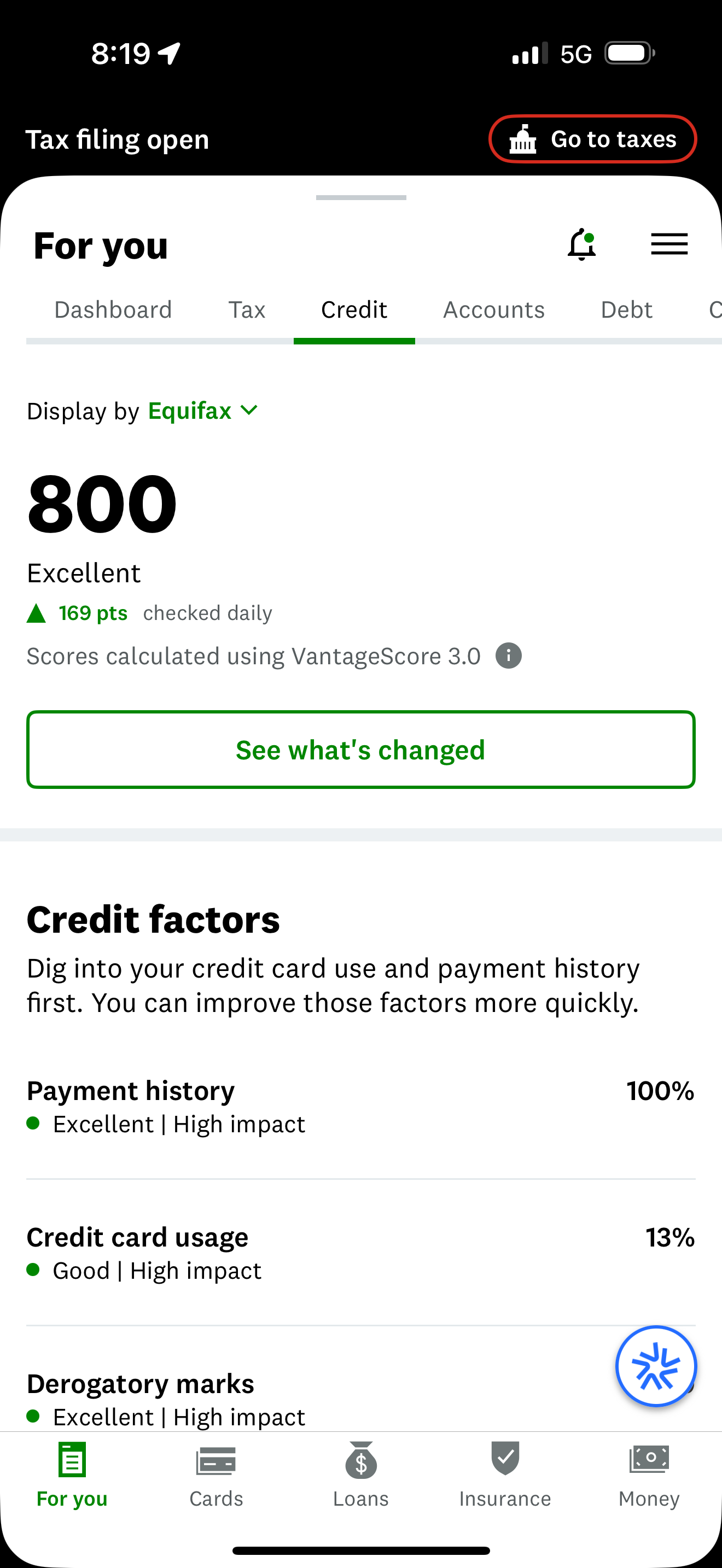

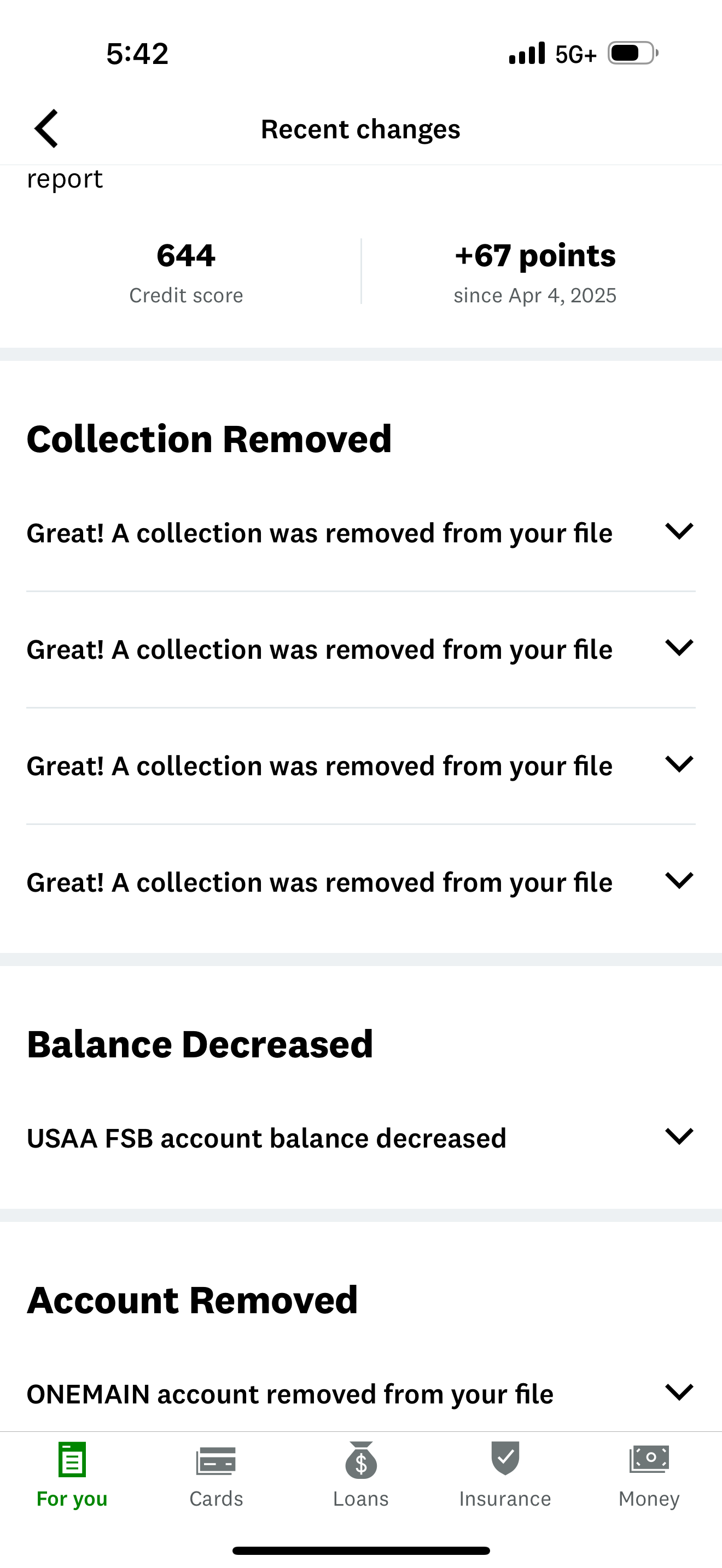

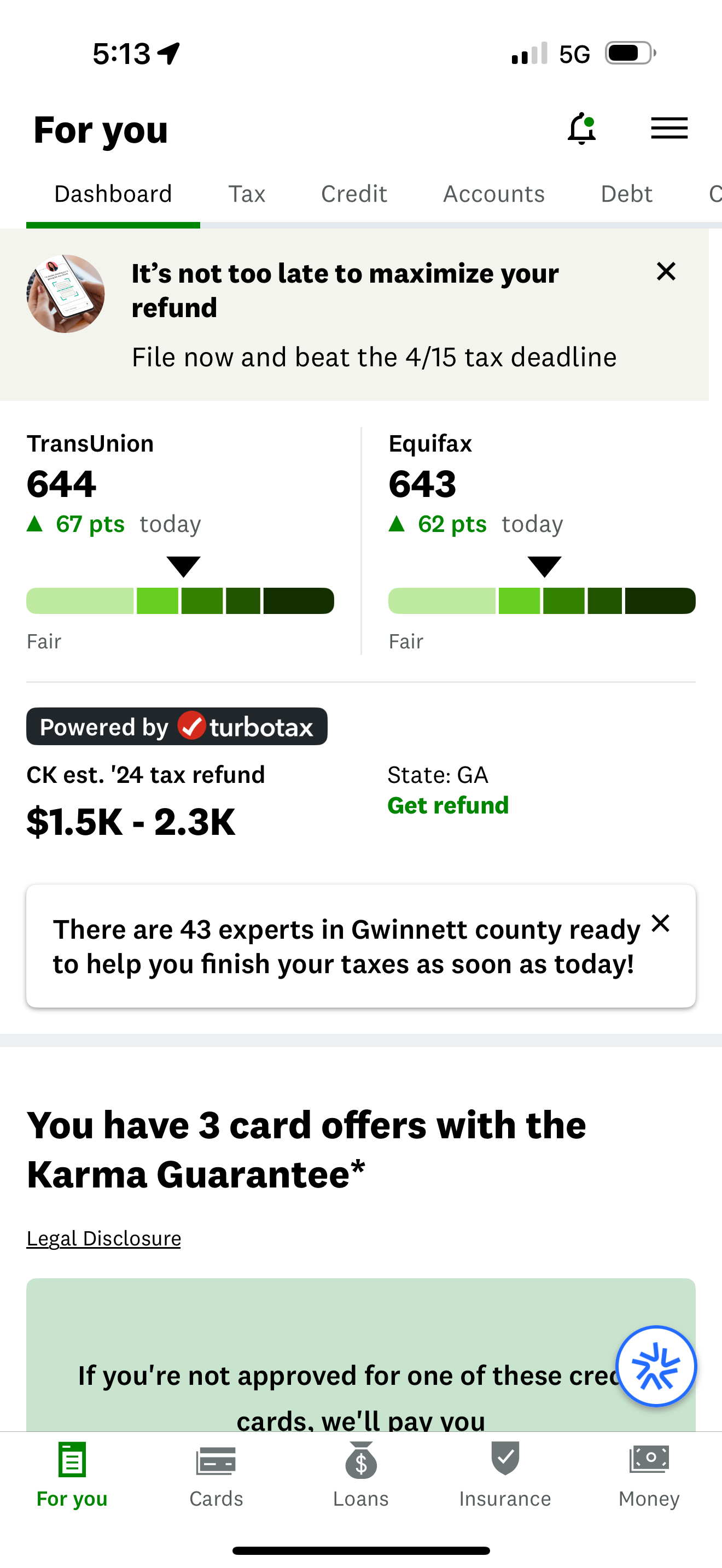

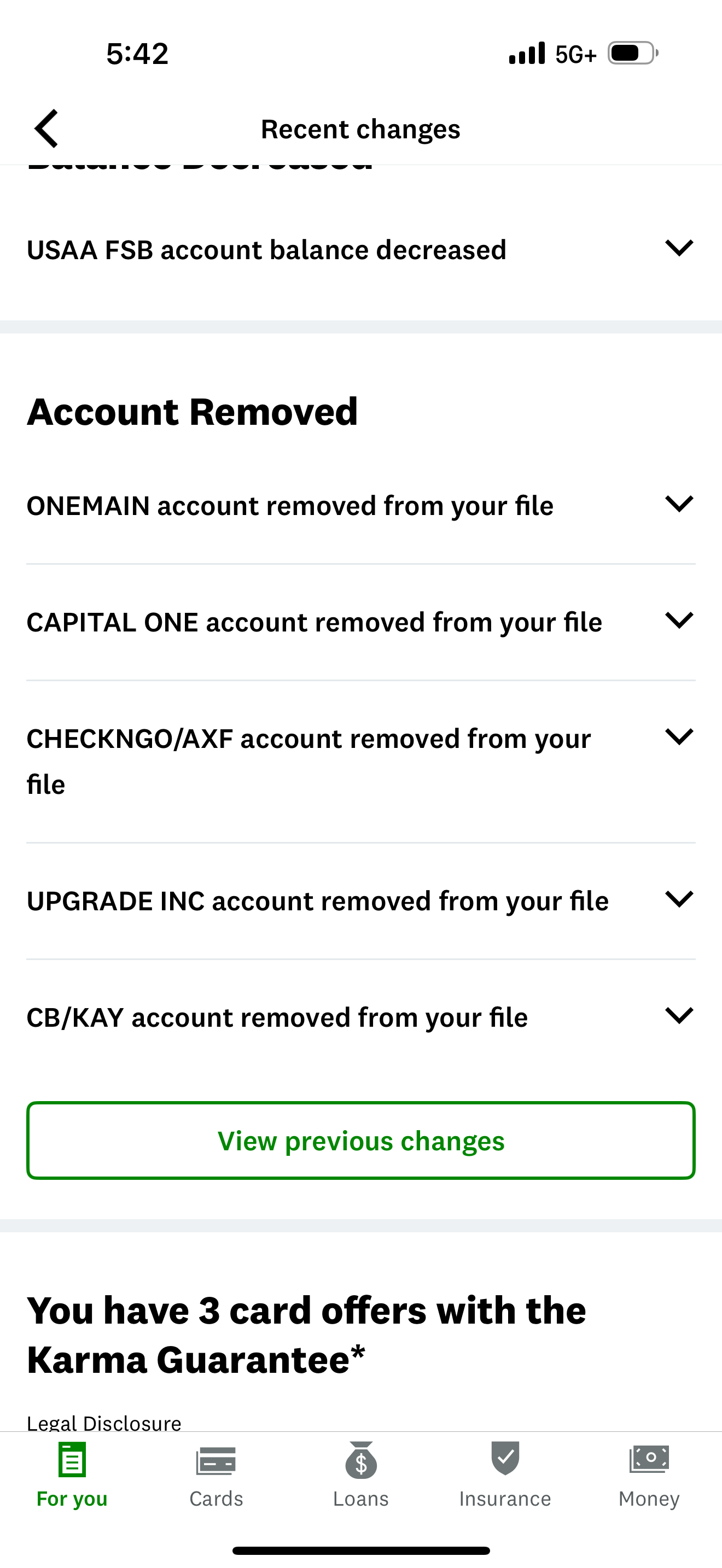

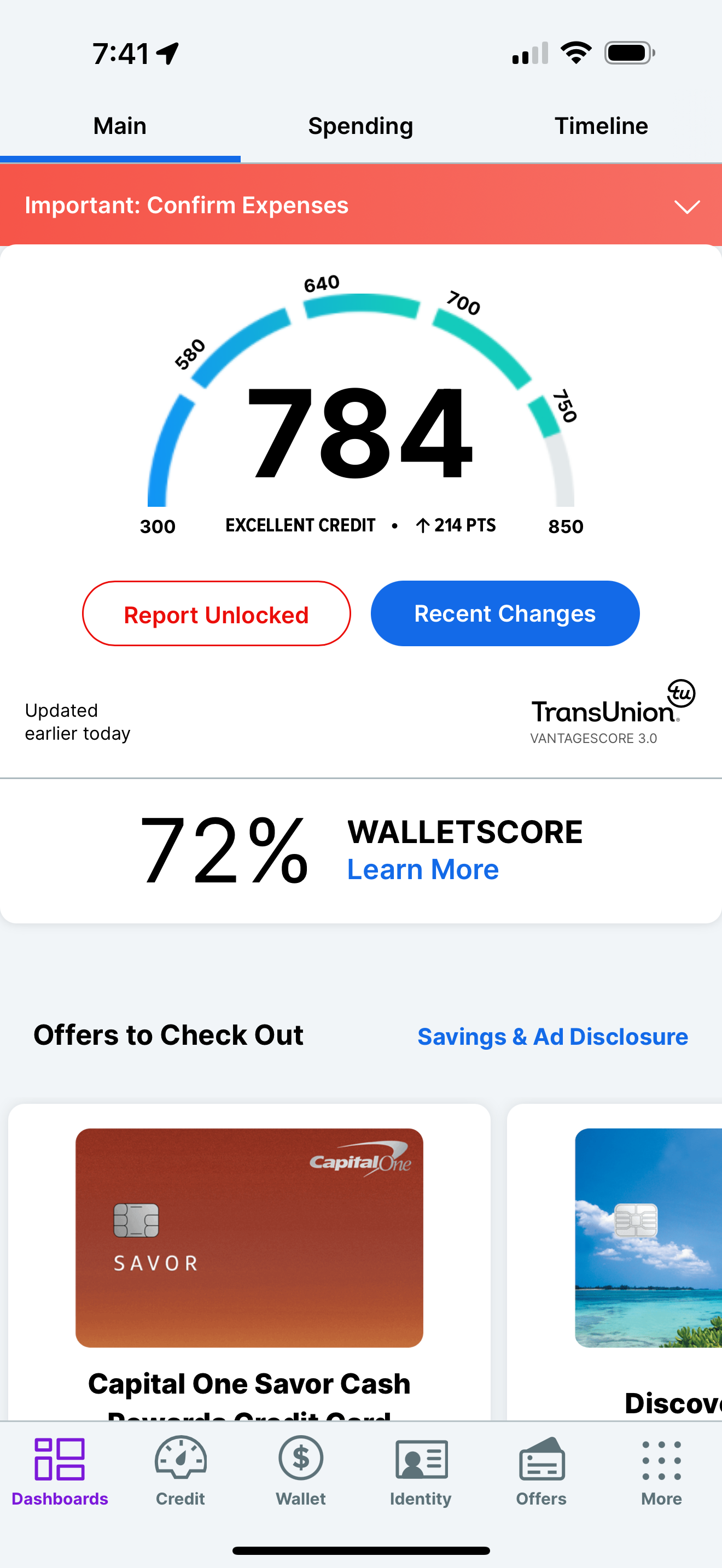

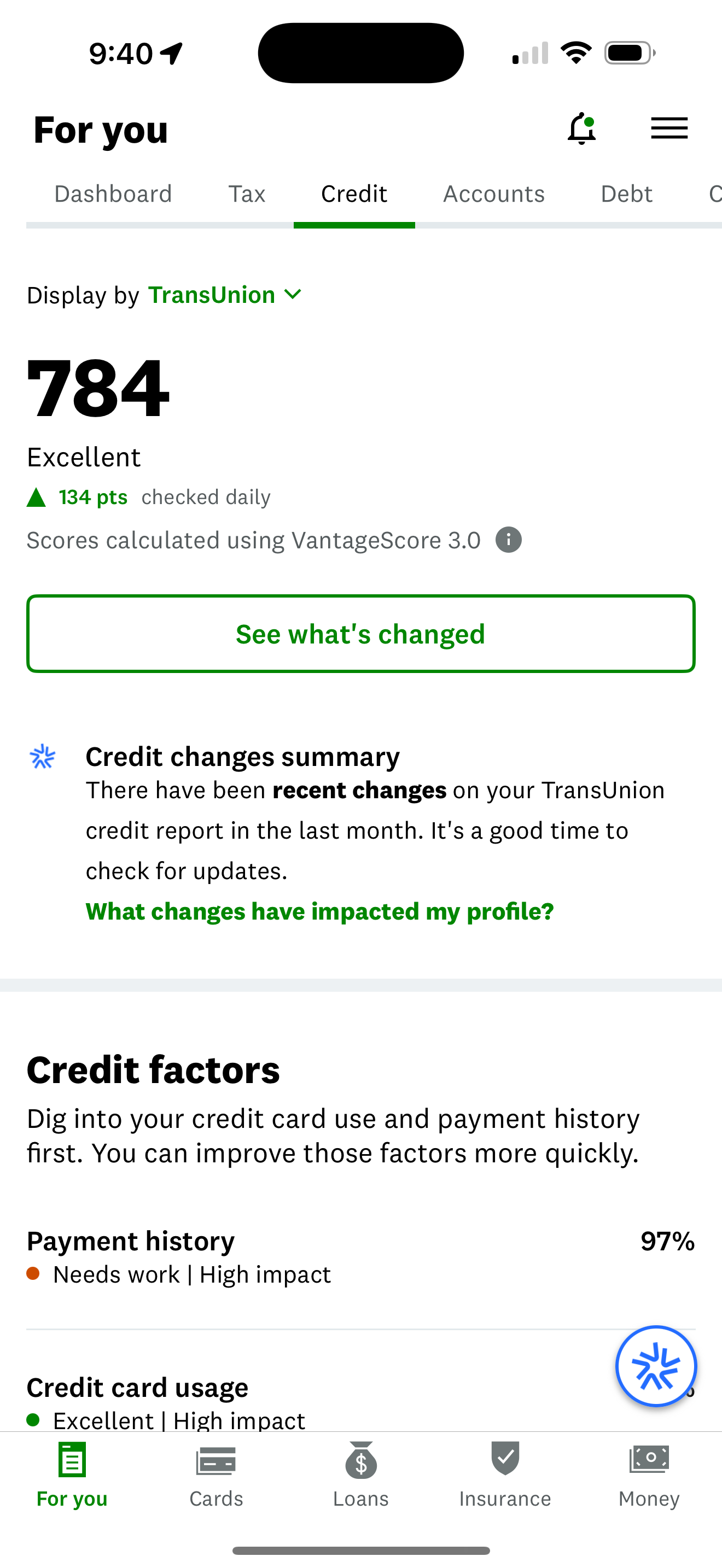

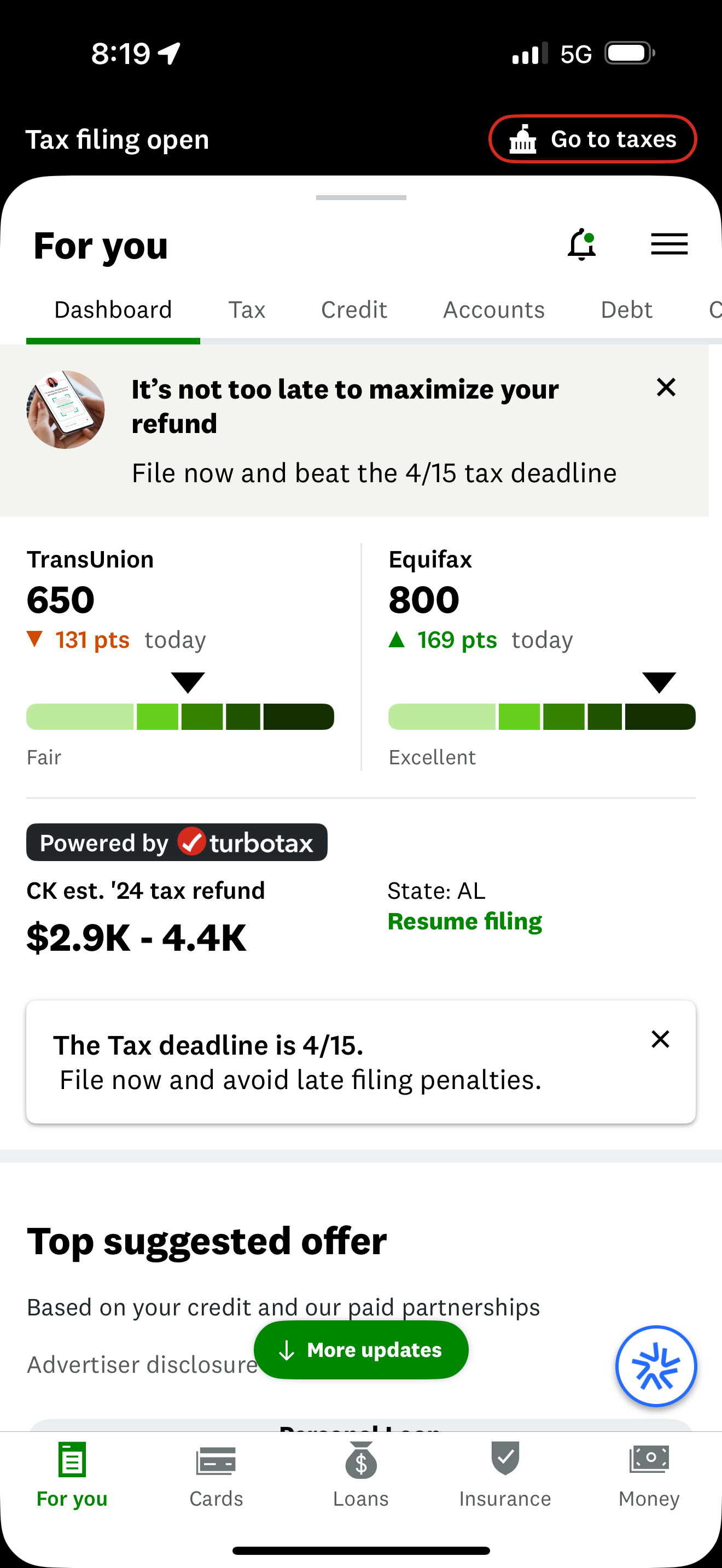

Real People, Real Results

See the credit transformations our clients have experienced

Ready to Build Your Credit the Smart Way?

Schedule a consultation and take the first step toward better credit.