Access the Capital Your Business Needs to Scale

Leverage your personal credit to secure up to $250,000 in 0% interest business funding.

Most Businesses Don't Fail from Lack of Effort

They fail from lack of capital.

Capital constraints force slower growth and delayed investment. CapitalPath removes this limitation by connecting qualified business owners with the funding they need to scale.

Why Capital Matters

Growth requires capital allocation. Capital is used to:

- Scale operations

- Upgrade systems

- Hire talent

- Market and expand visibility

- Access mentorship

- Acquire assets and equipment

What is CapitalPath?

A smarter way to fund your business

CapitalPath helps qualified owners leverage personal credit to access 0% interest business funding for up to twelve months. This capital can be used to scale operations, invest in growth, and position your business for long-term success.

Funding Available

Interest Rate

Months Term

How the Funding Works

A simple, effective process

Credit and Positioning Review

We review your current credit profile to determine your funding potential and identify any areas that need attention before applying.

Lender Matching

Based on your profile, we match you with the right lenders from our network of 0% APR business credit products.

Strategic Application Sequencing

Applications are submitted strategically to maximize approvals while minimizing credit inquiries and timing impacts.

Access to 0% Business Credit Products

Once approved, you gain access to business credit lines with 0% interest introductory periods, typically lasting 12-18 months.

Use Personal Credit to Build Business Credit

CapitalPath allows you to leverage your personal credit for immediate capital access while building long-term business credit positioning.

This dual approach means you're not just getting funding—you're building a foundation for future capital access directly through your business entity.

The Cost of Waiting

Delaying capital delays growth. Every month without adequate funding is a month of:

- Missed opportunities

- Slower scaling

- Reduced competitive advantage

- Limited strategic options

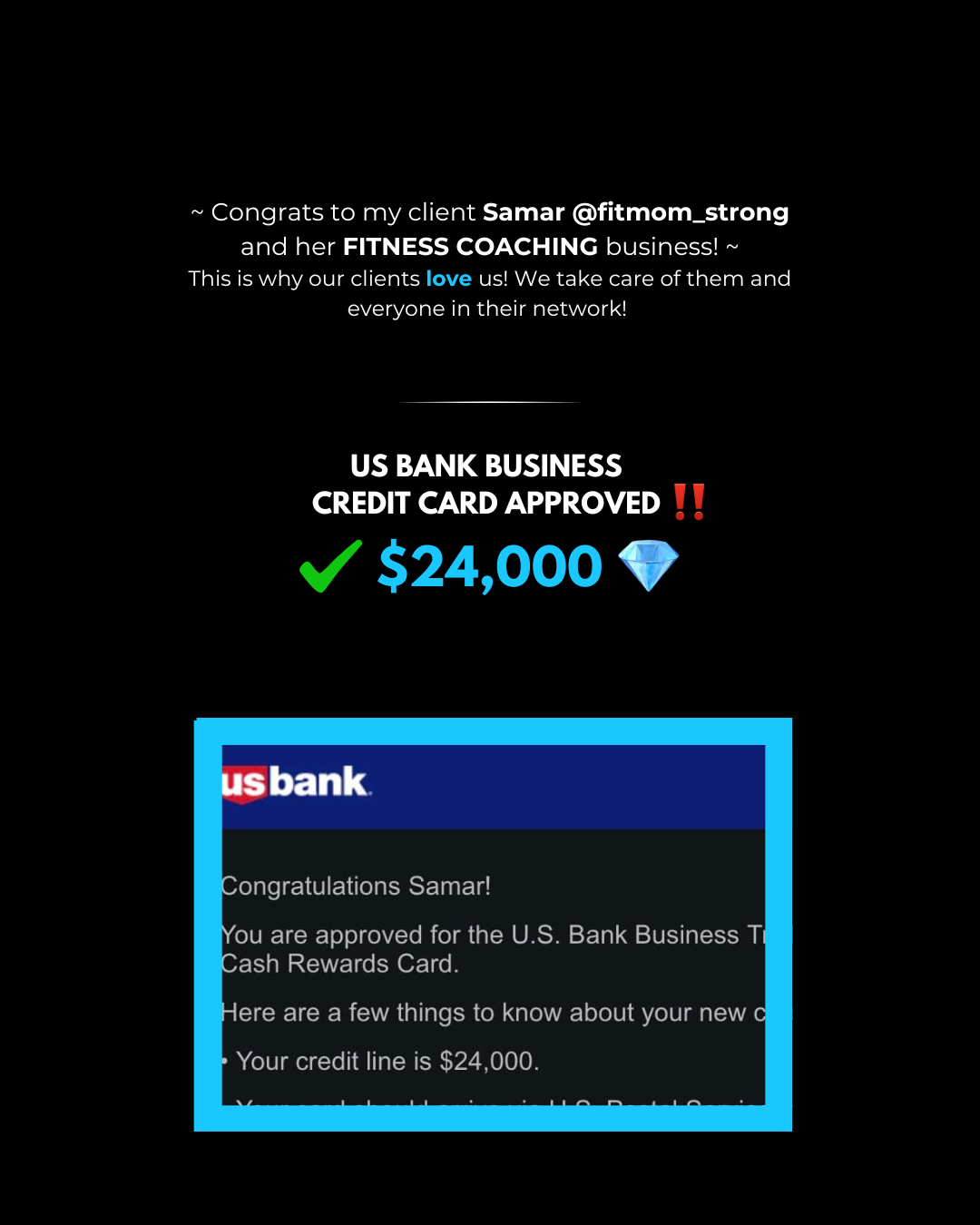

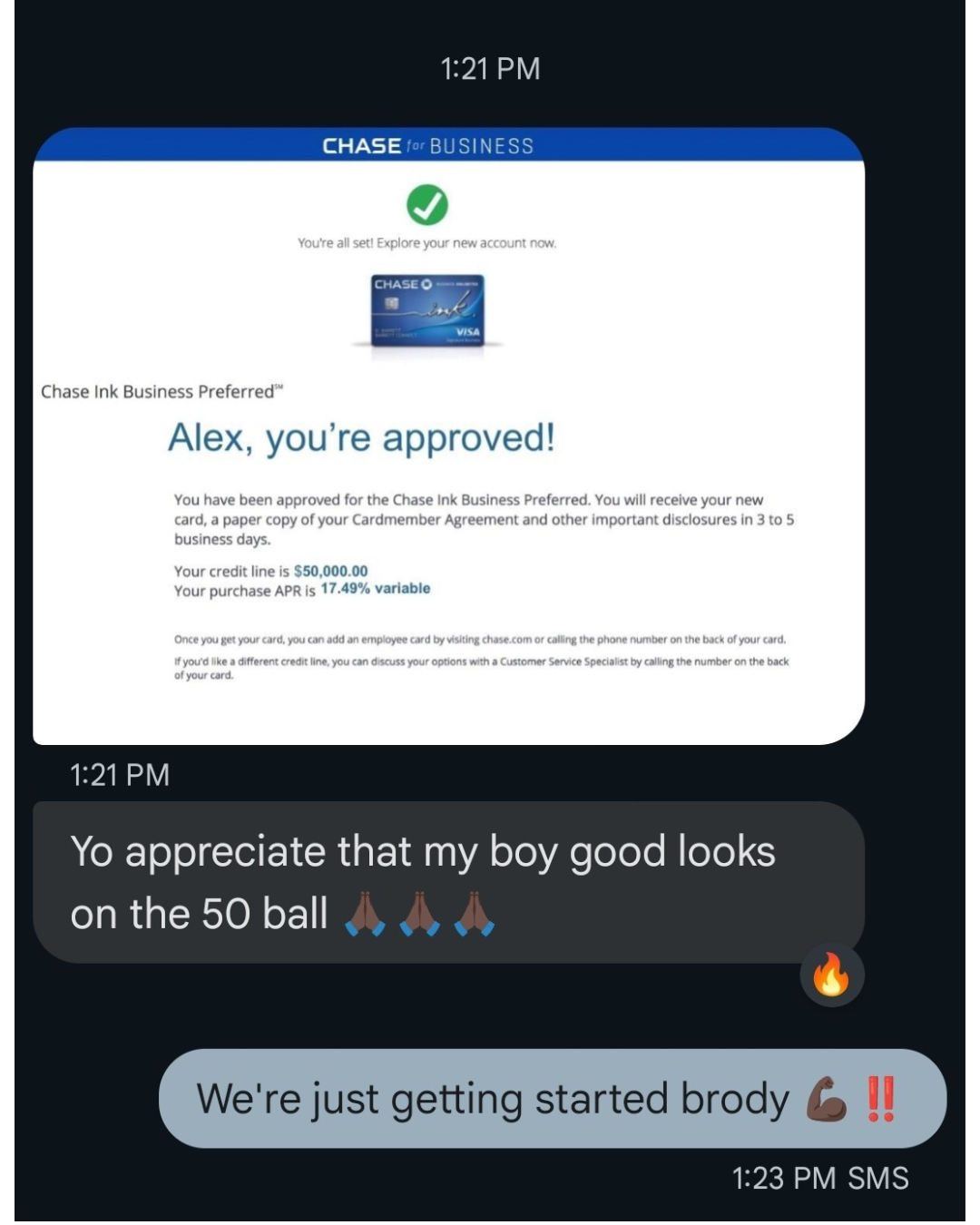

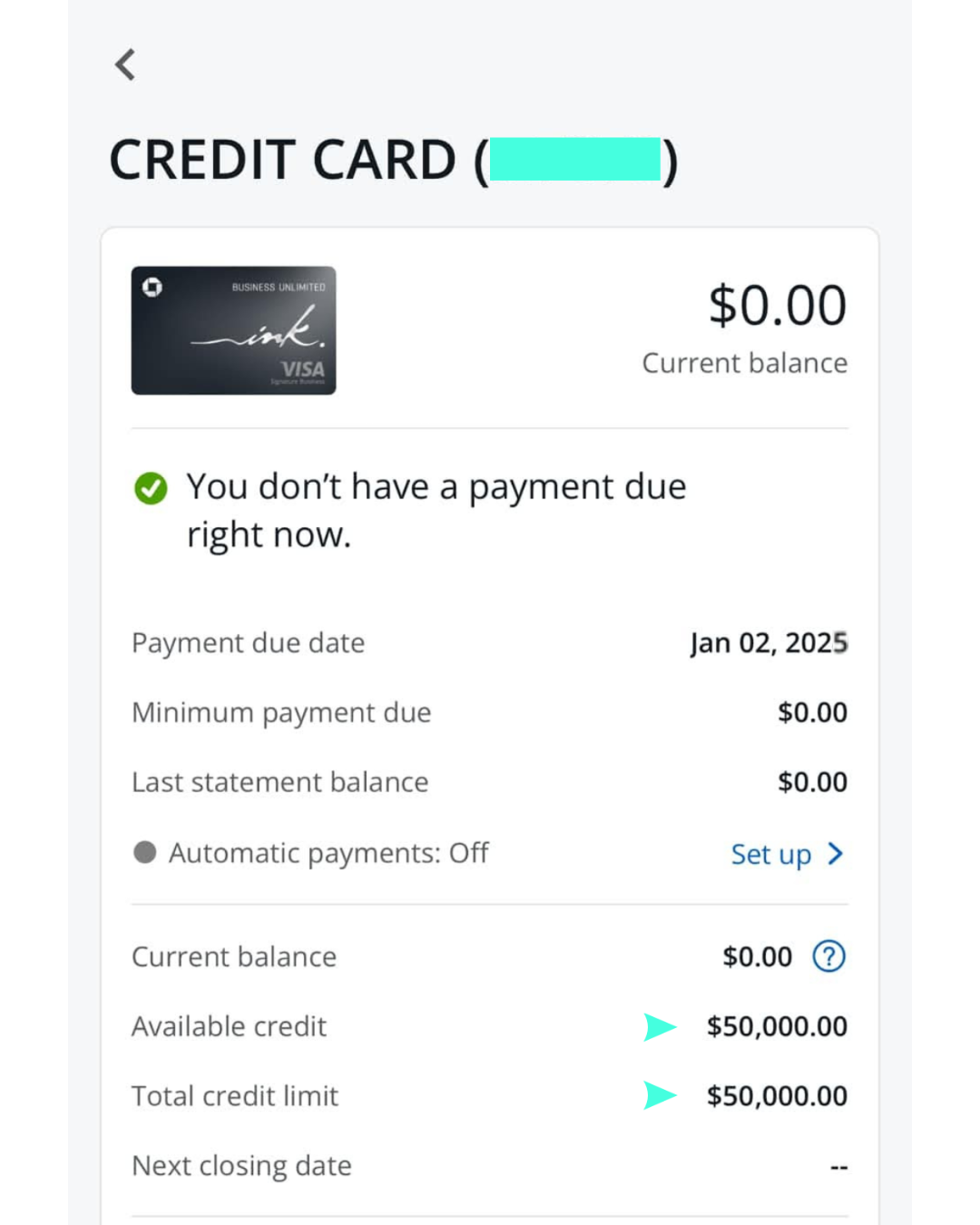

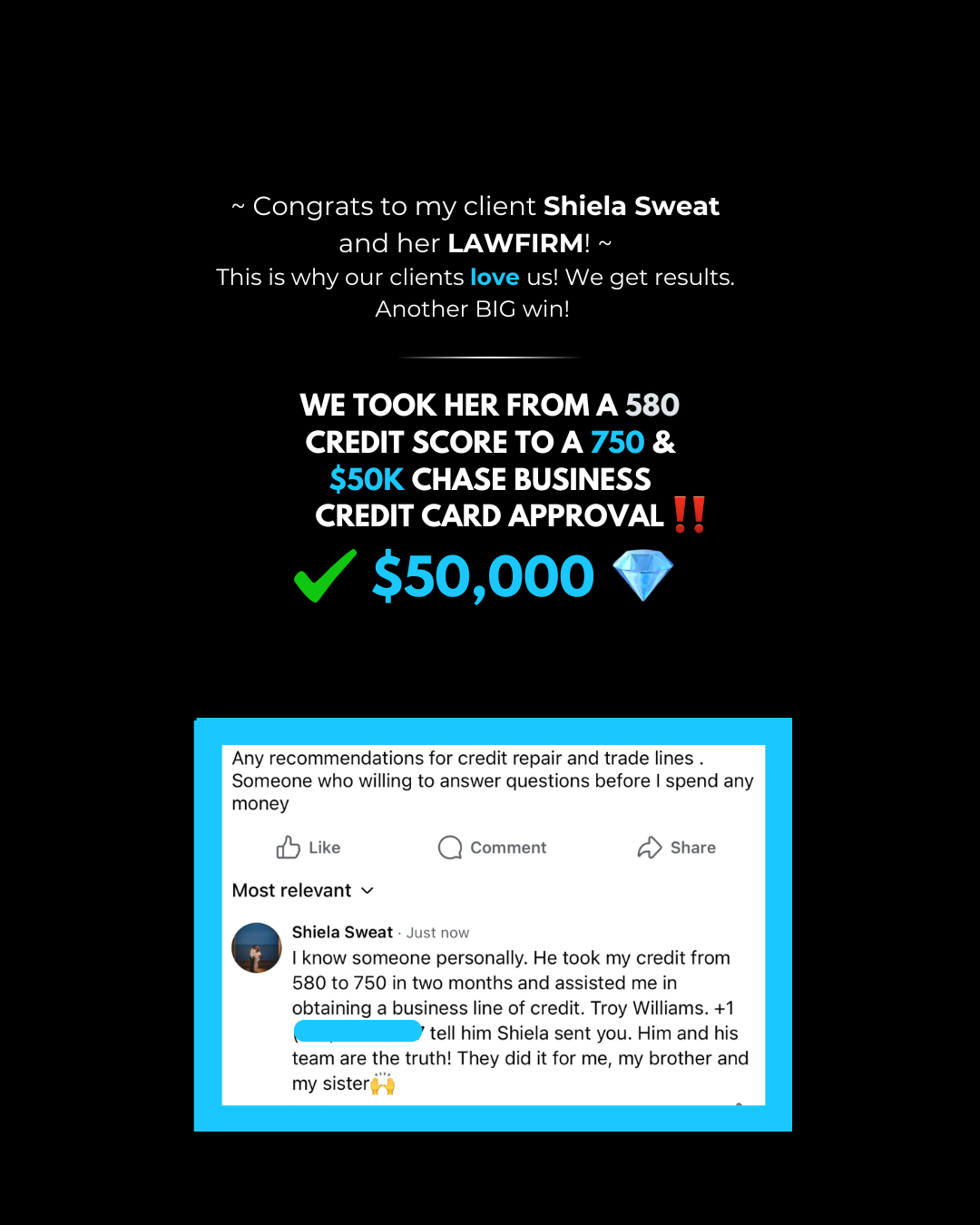

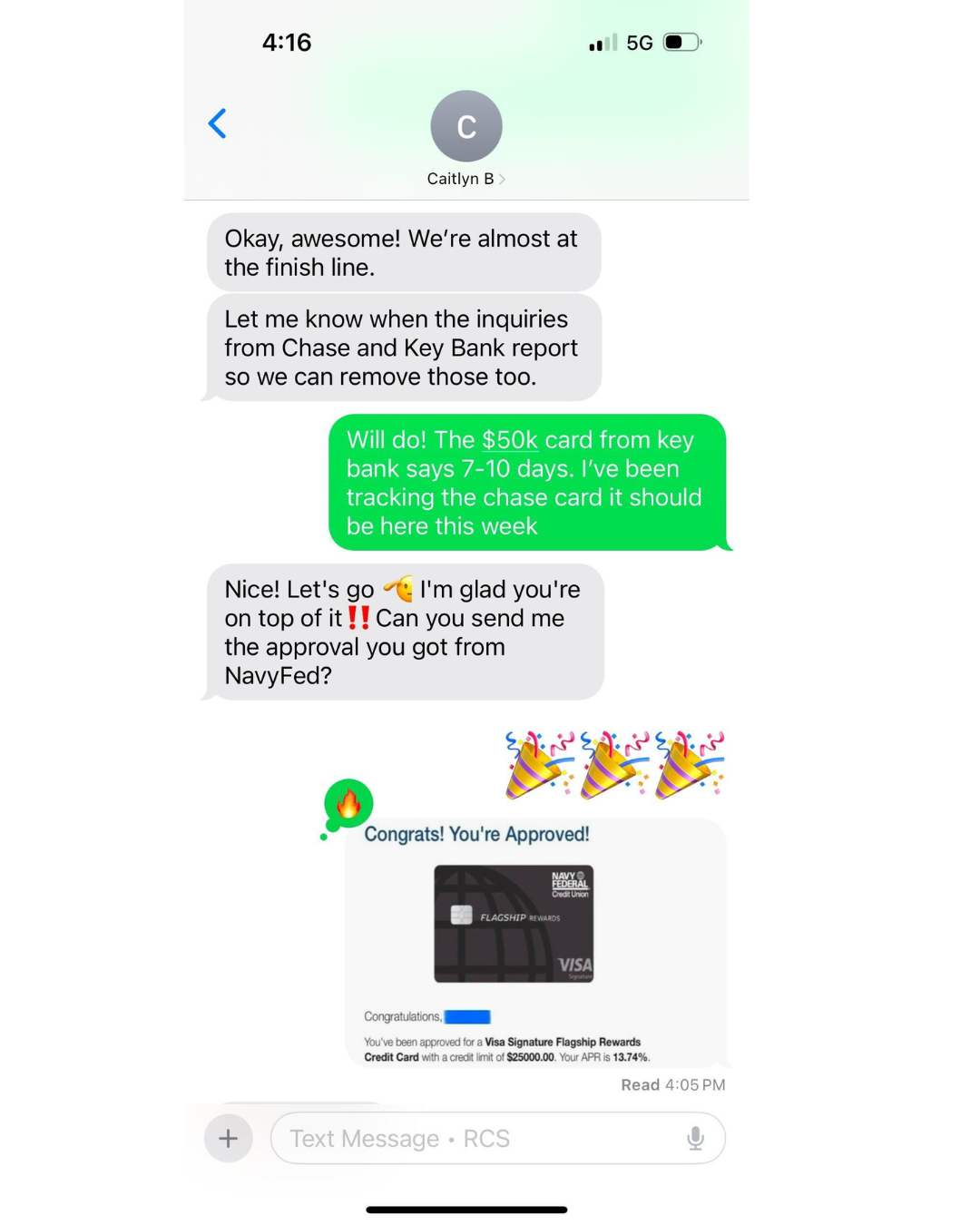

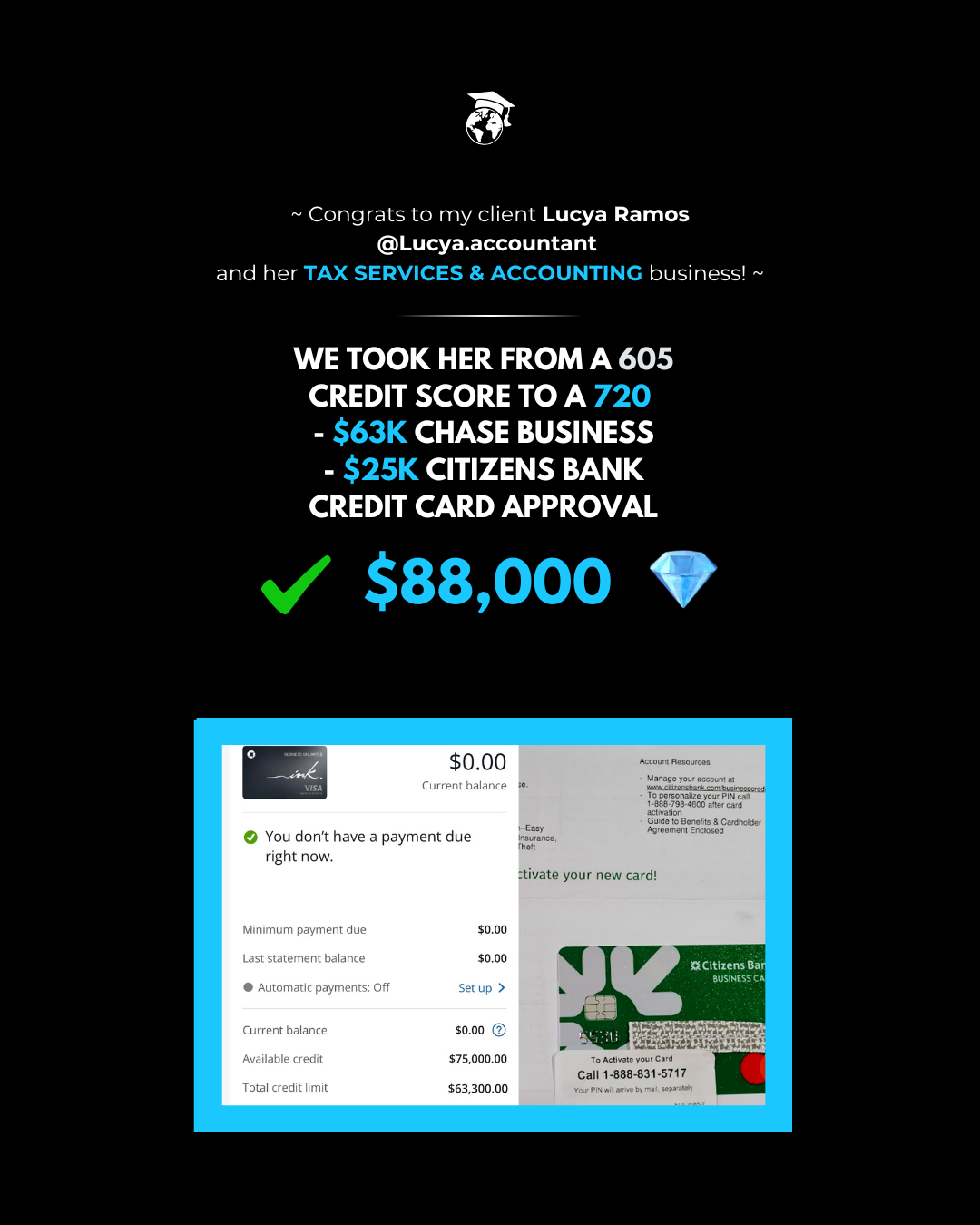

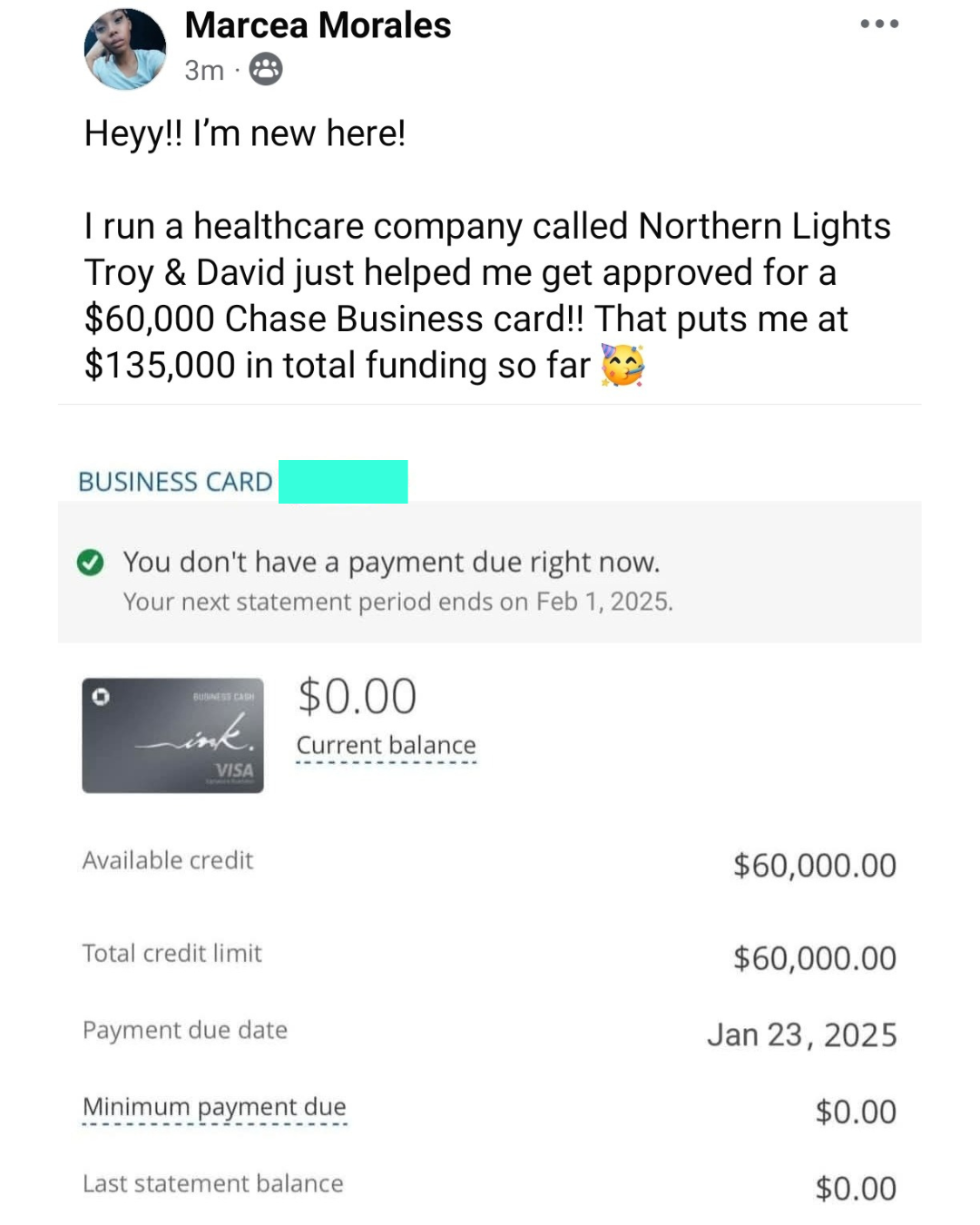

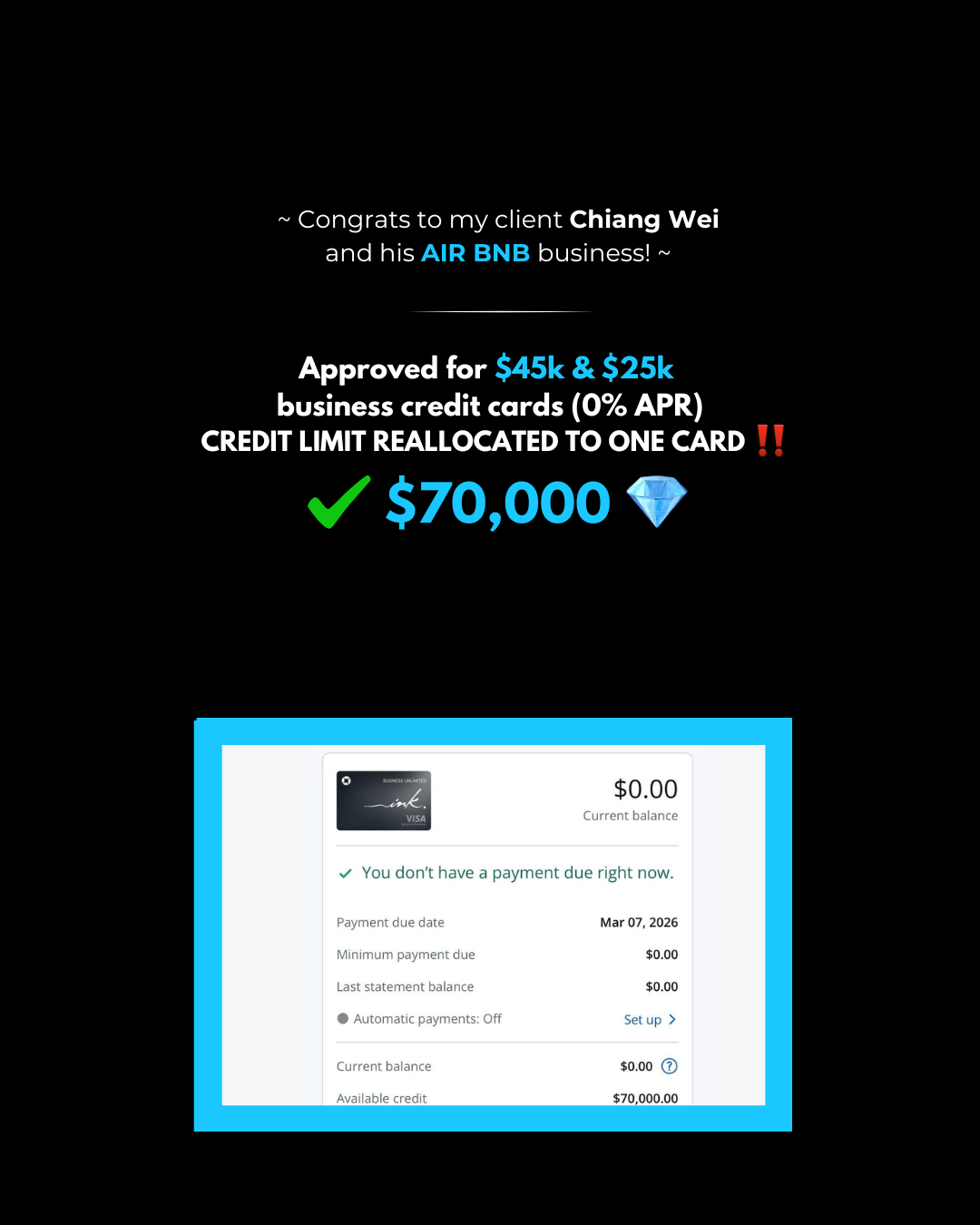

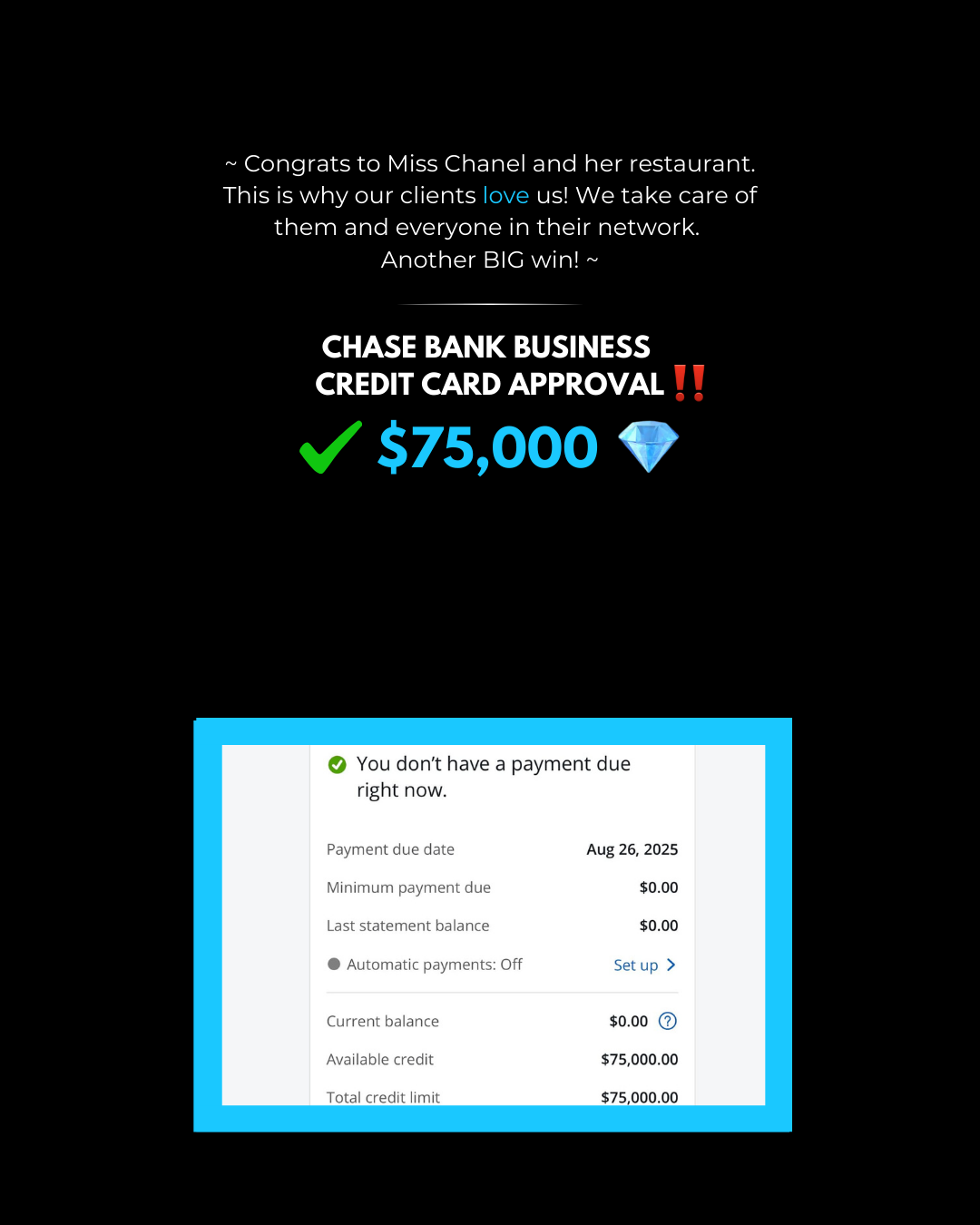

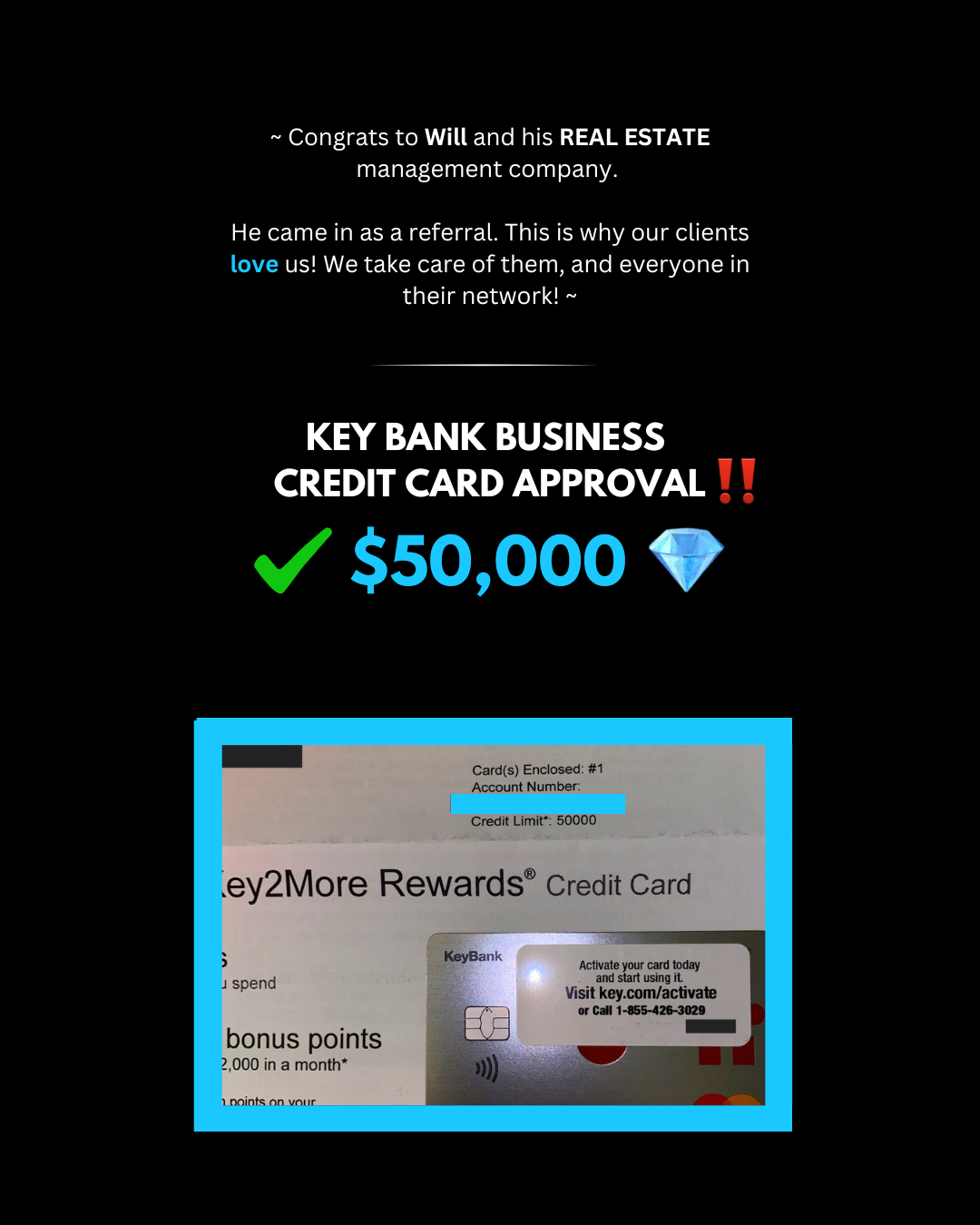

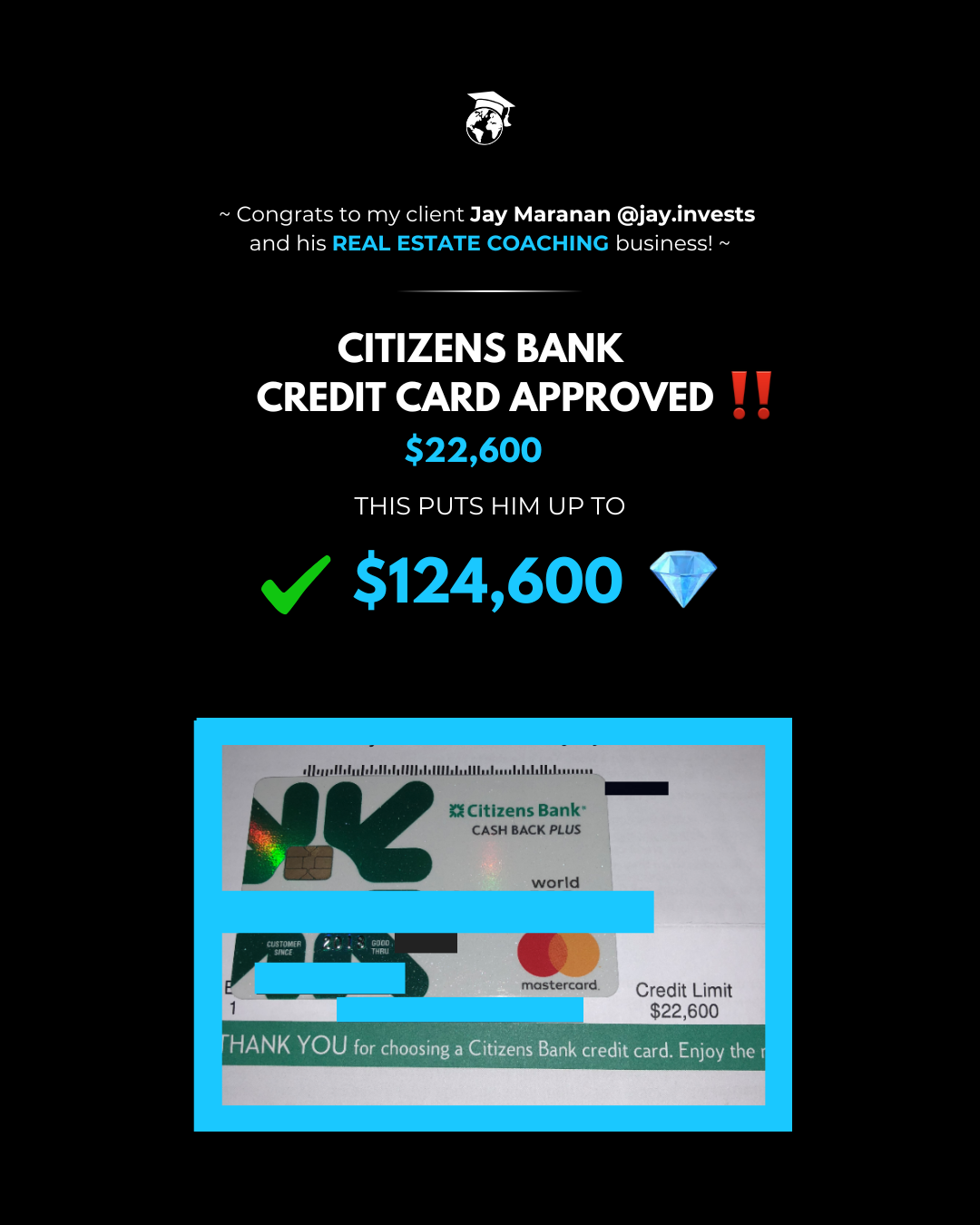

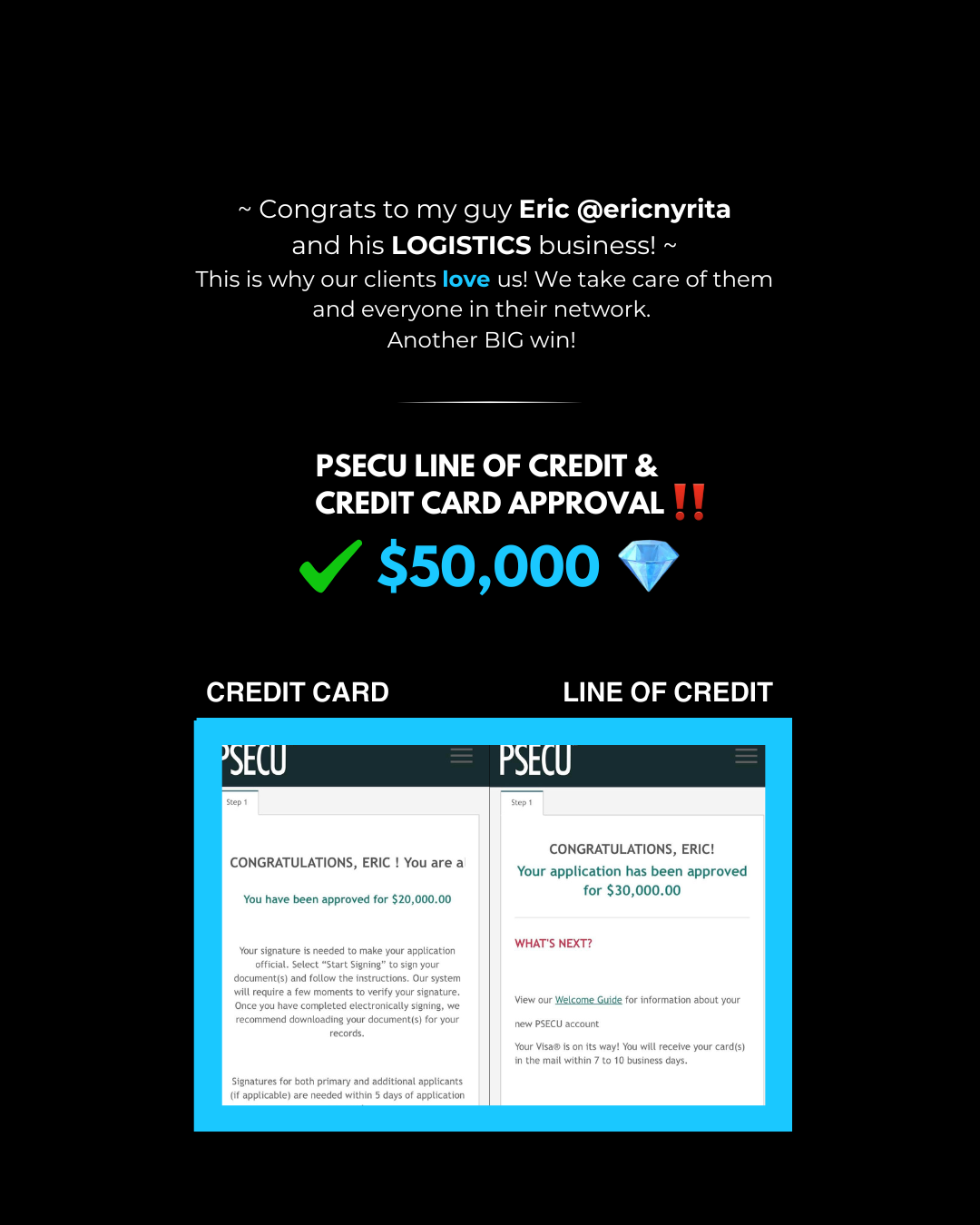

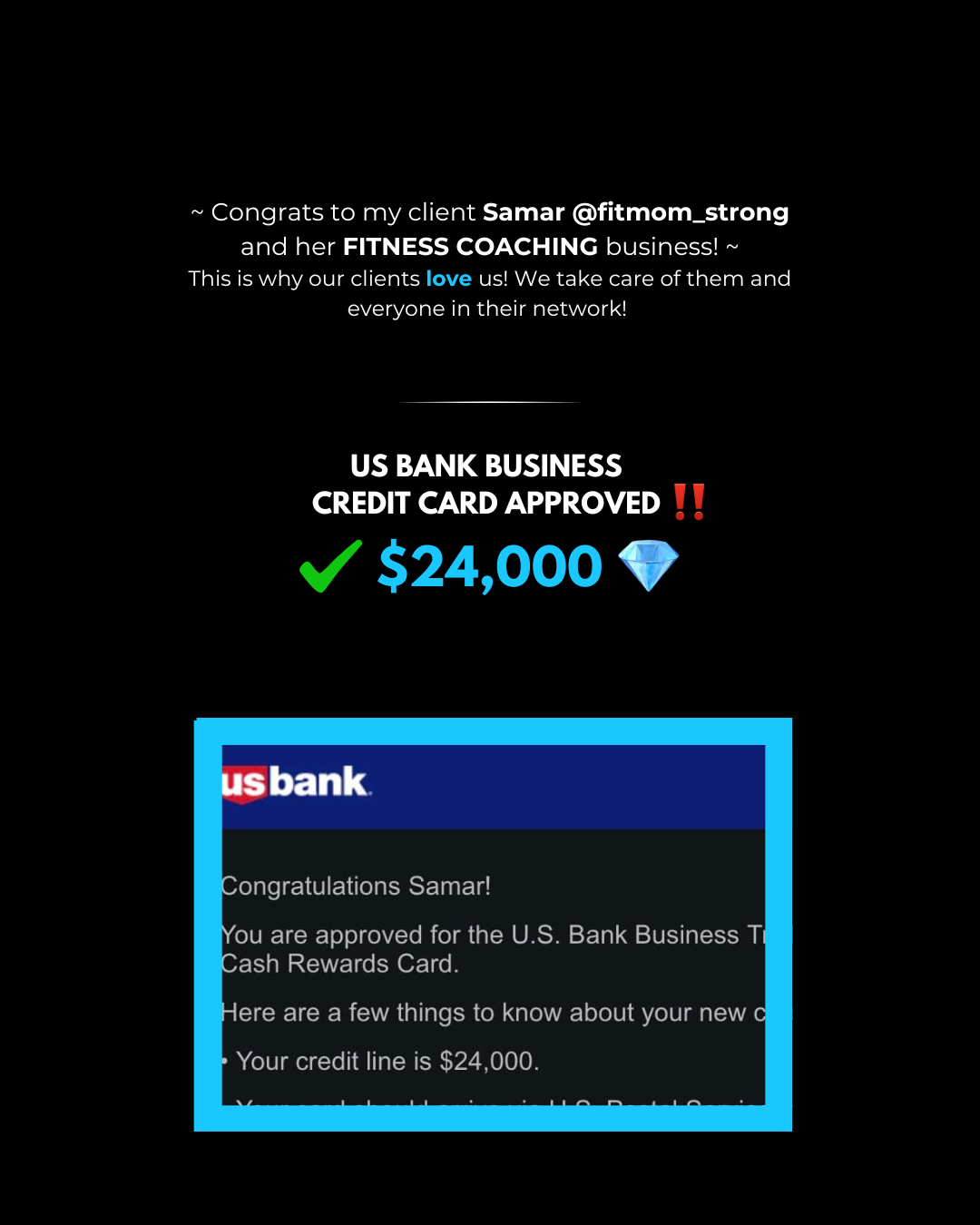

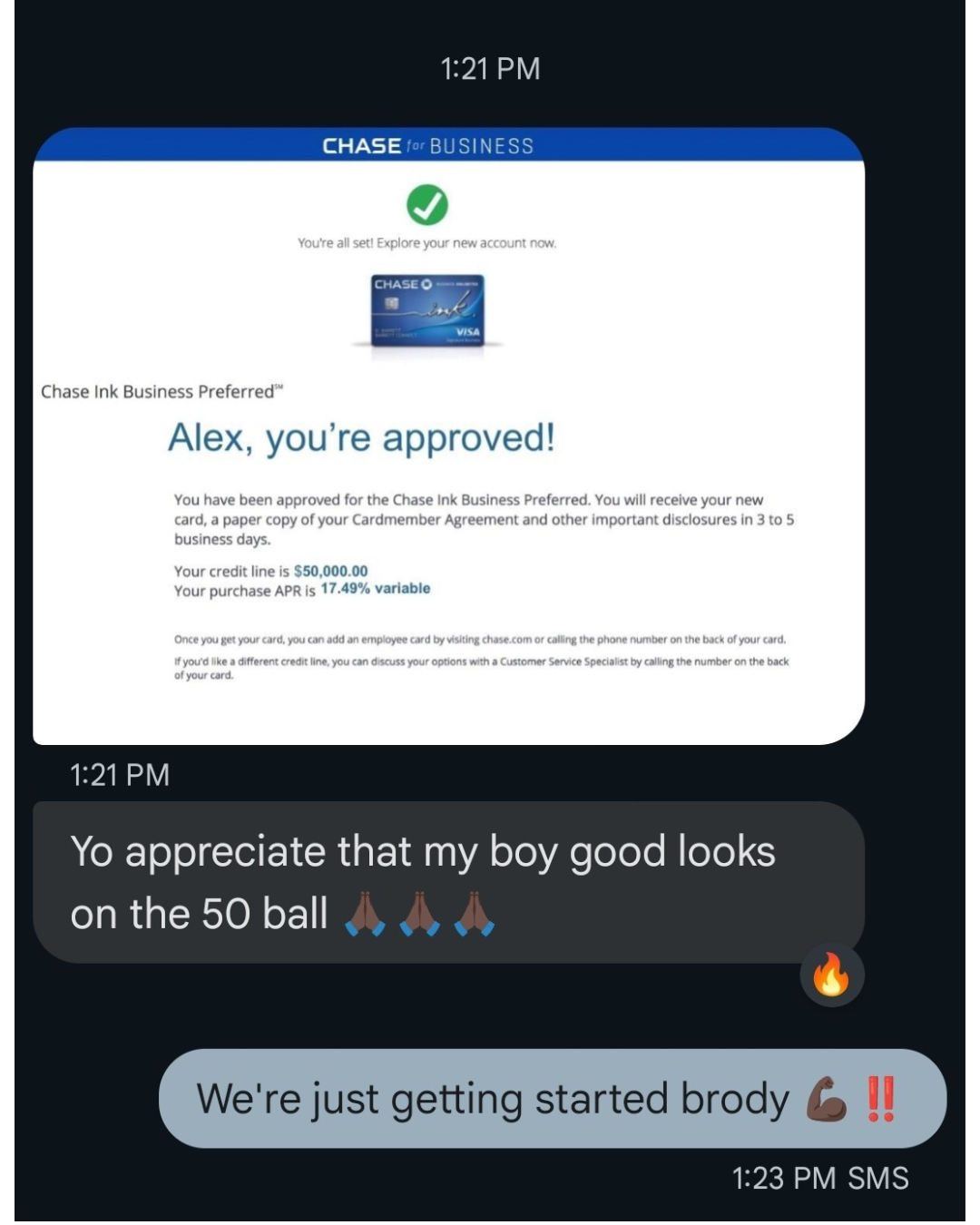

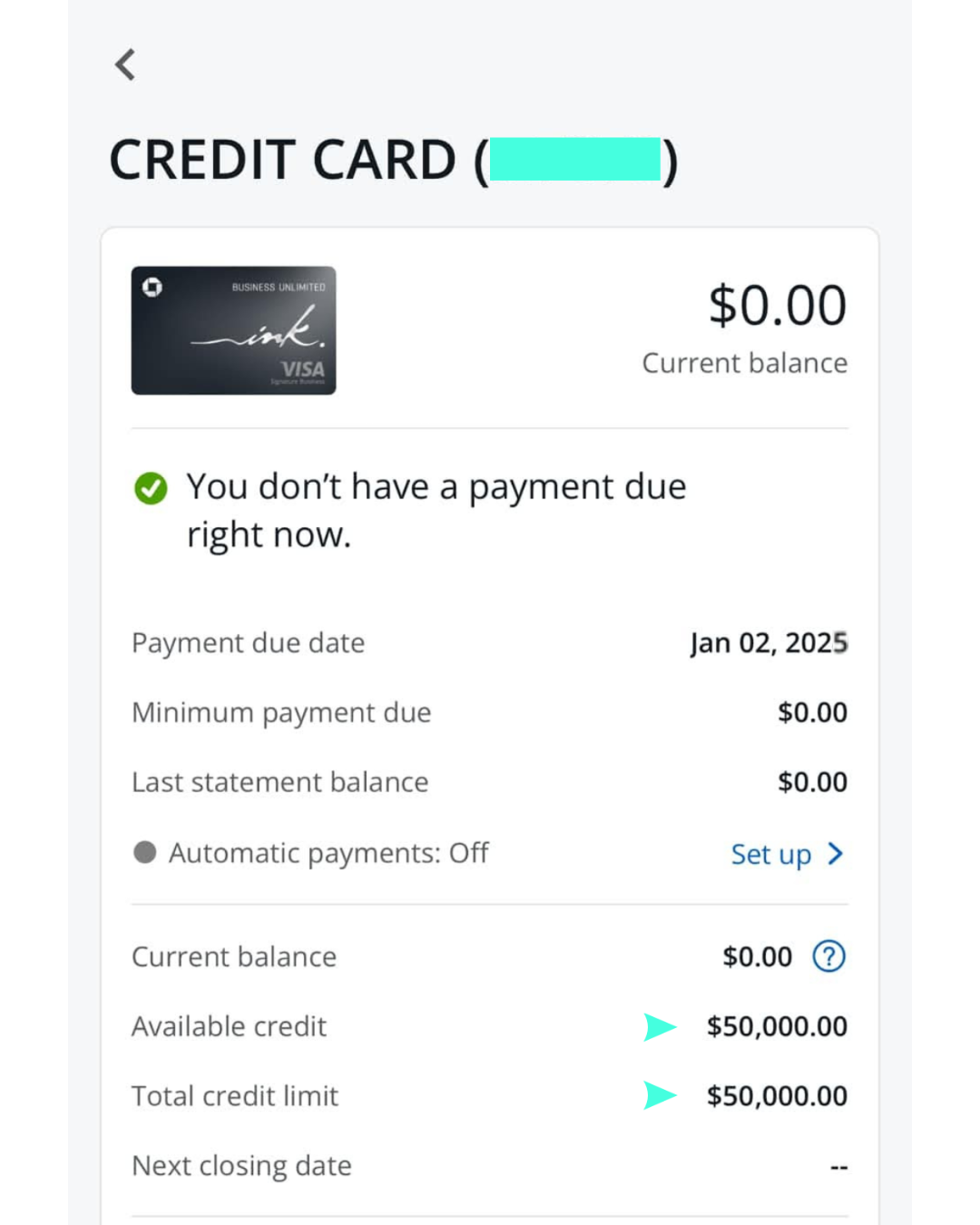

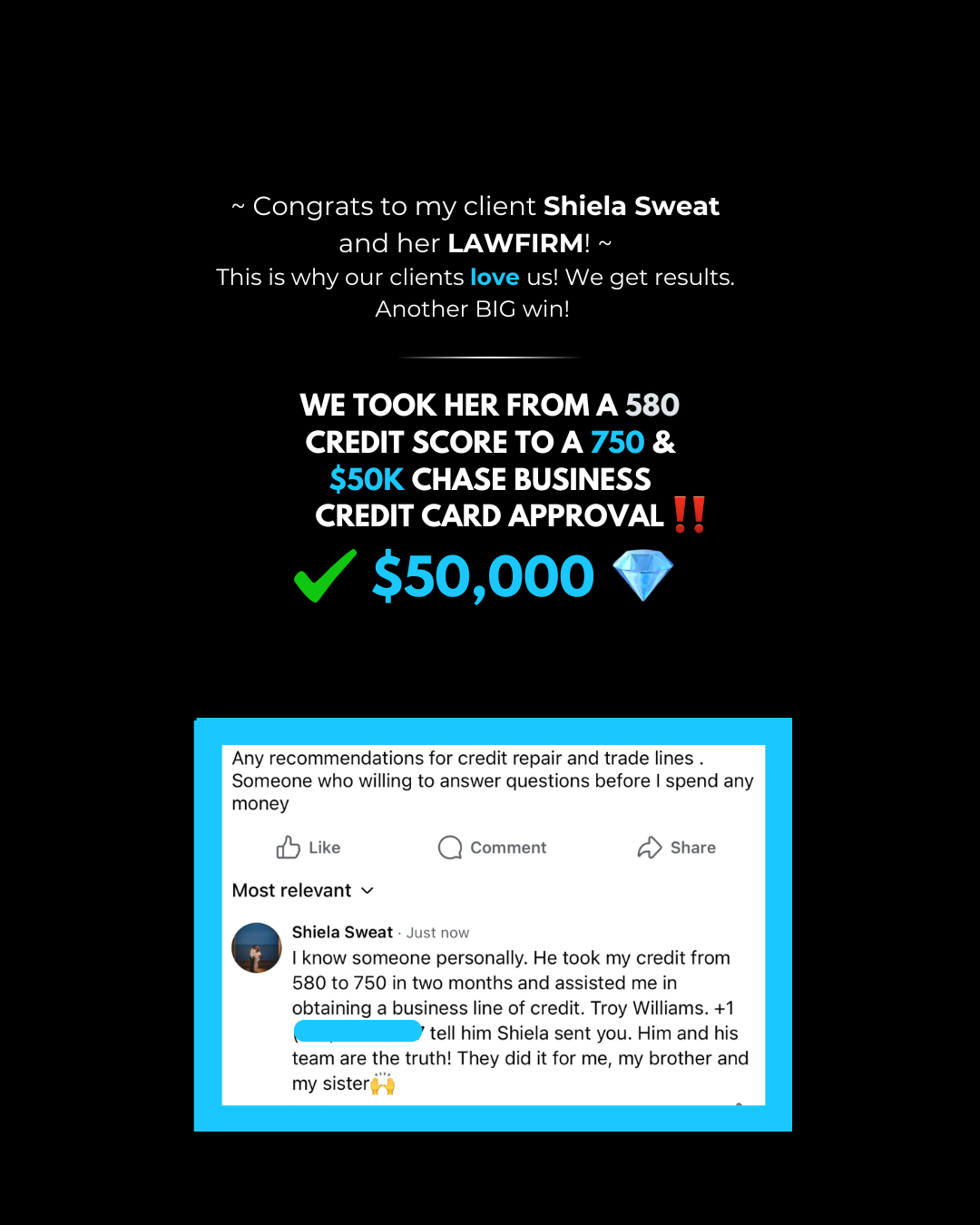

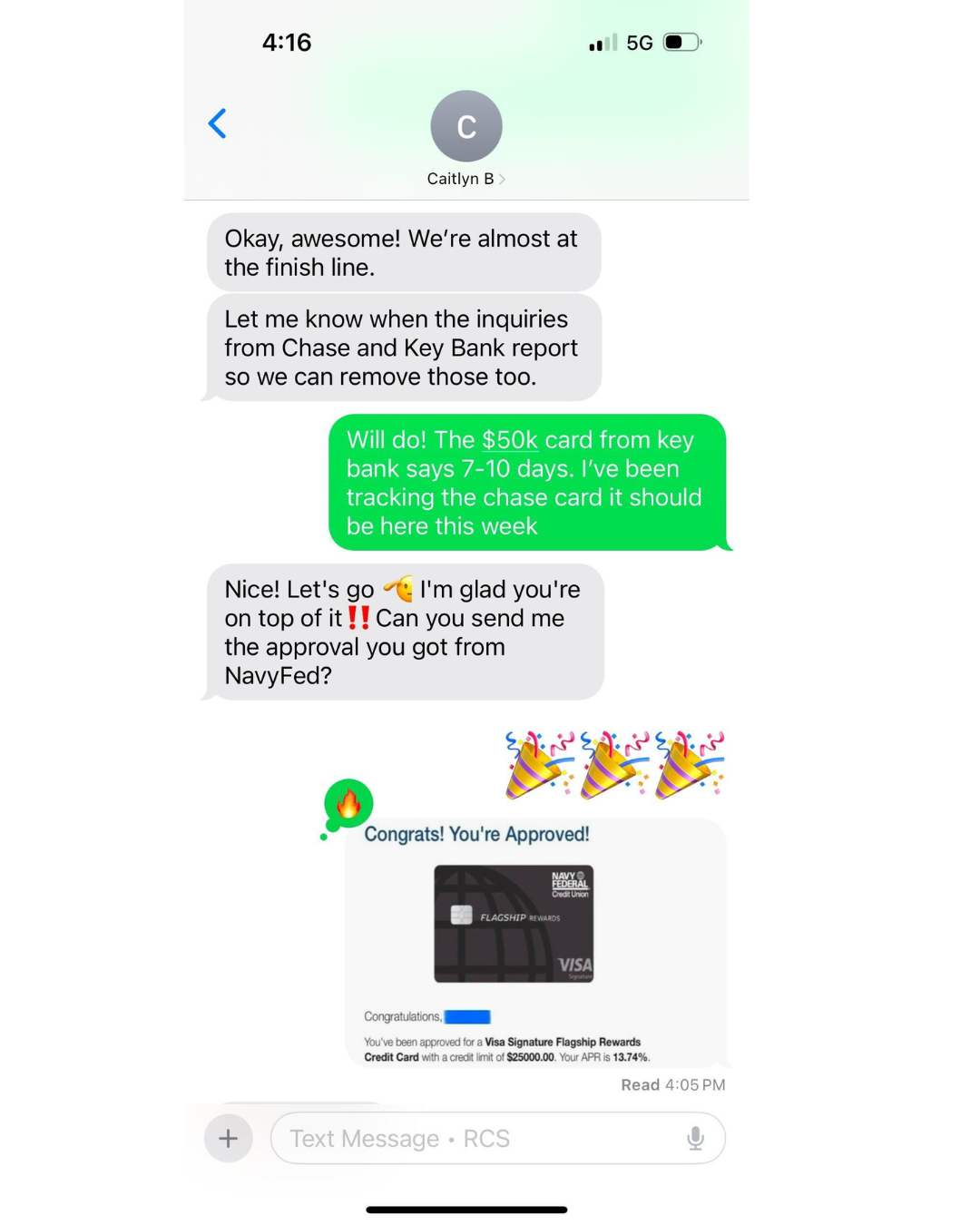

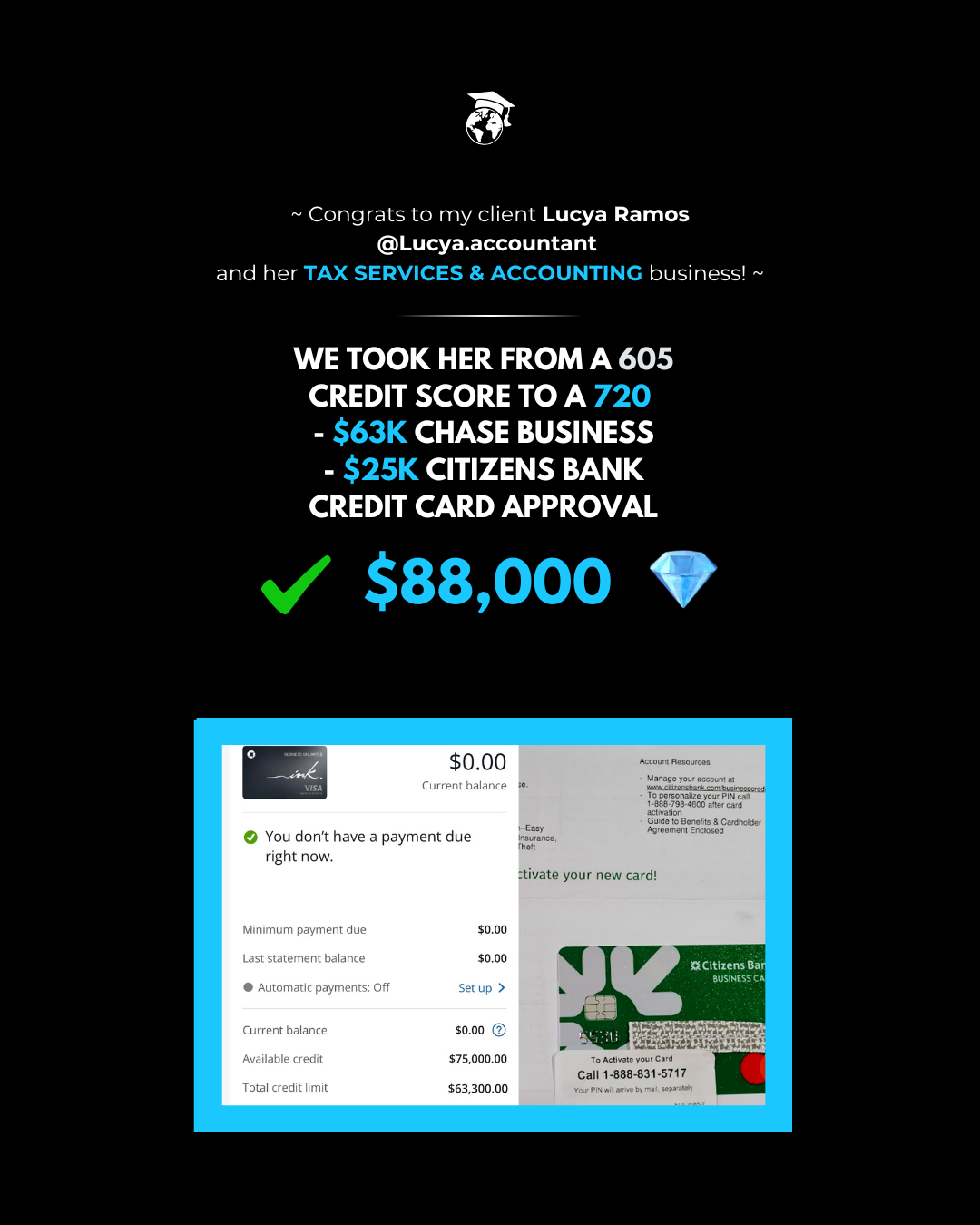

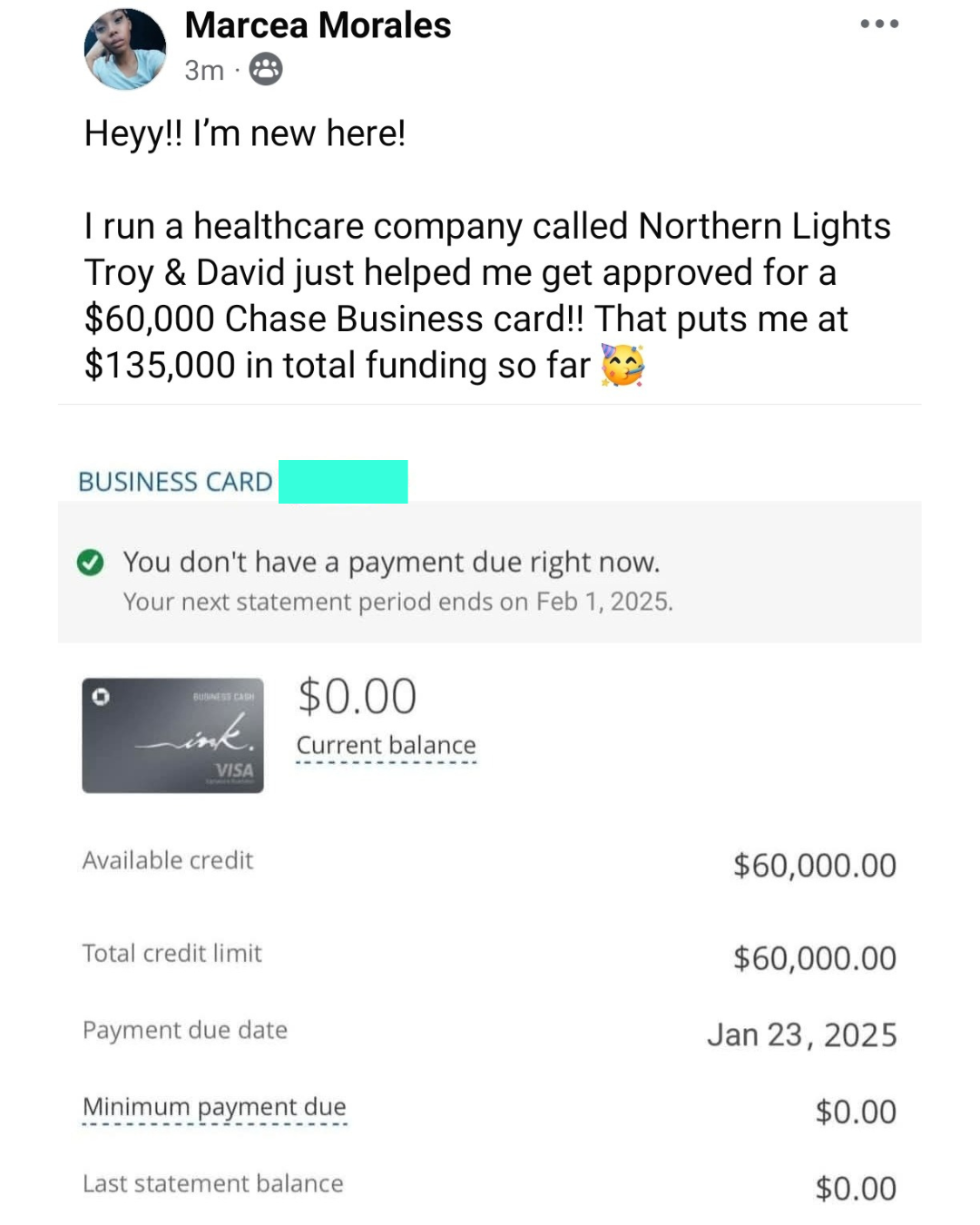

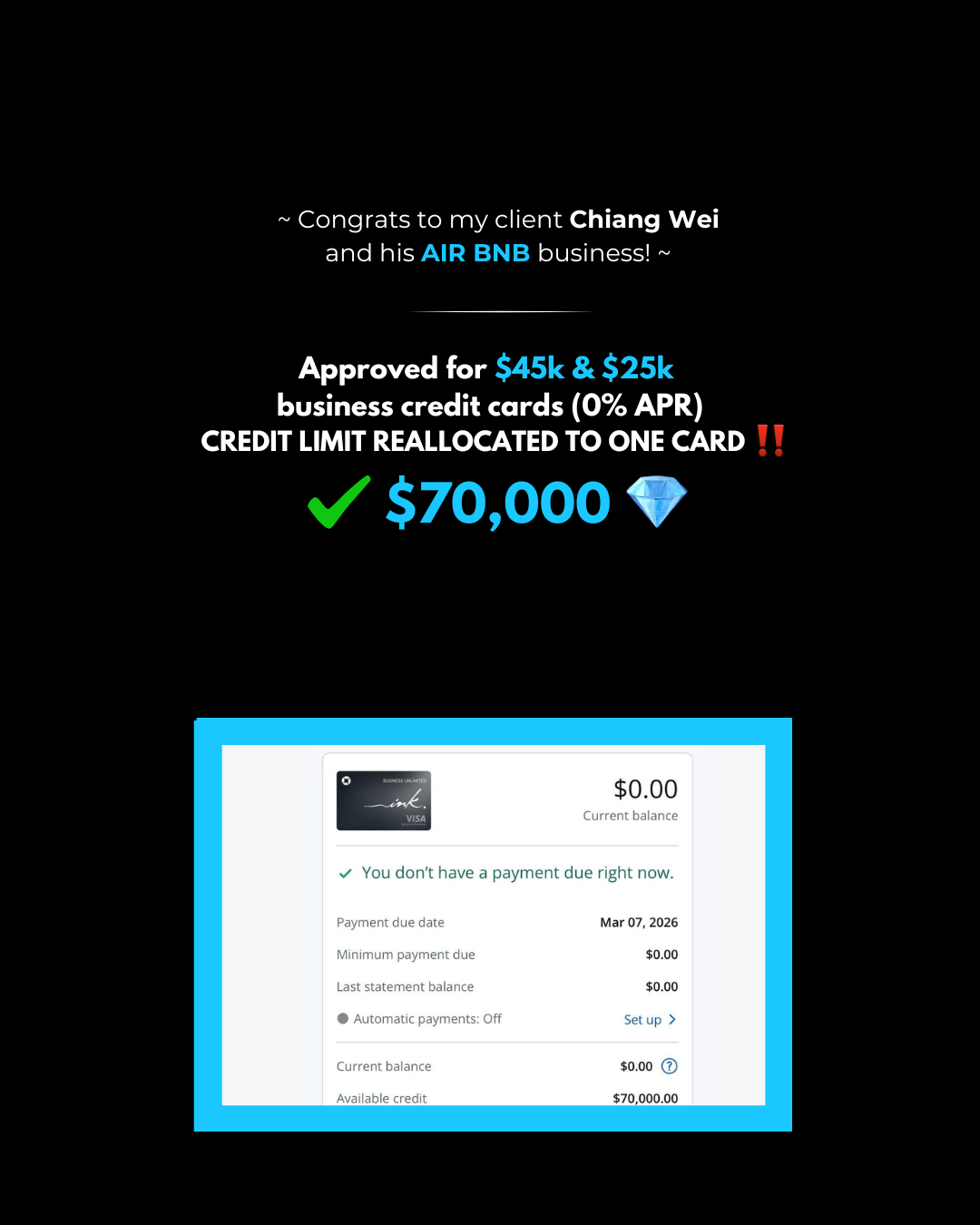

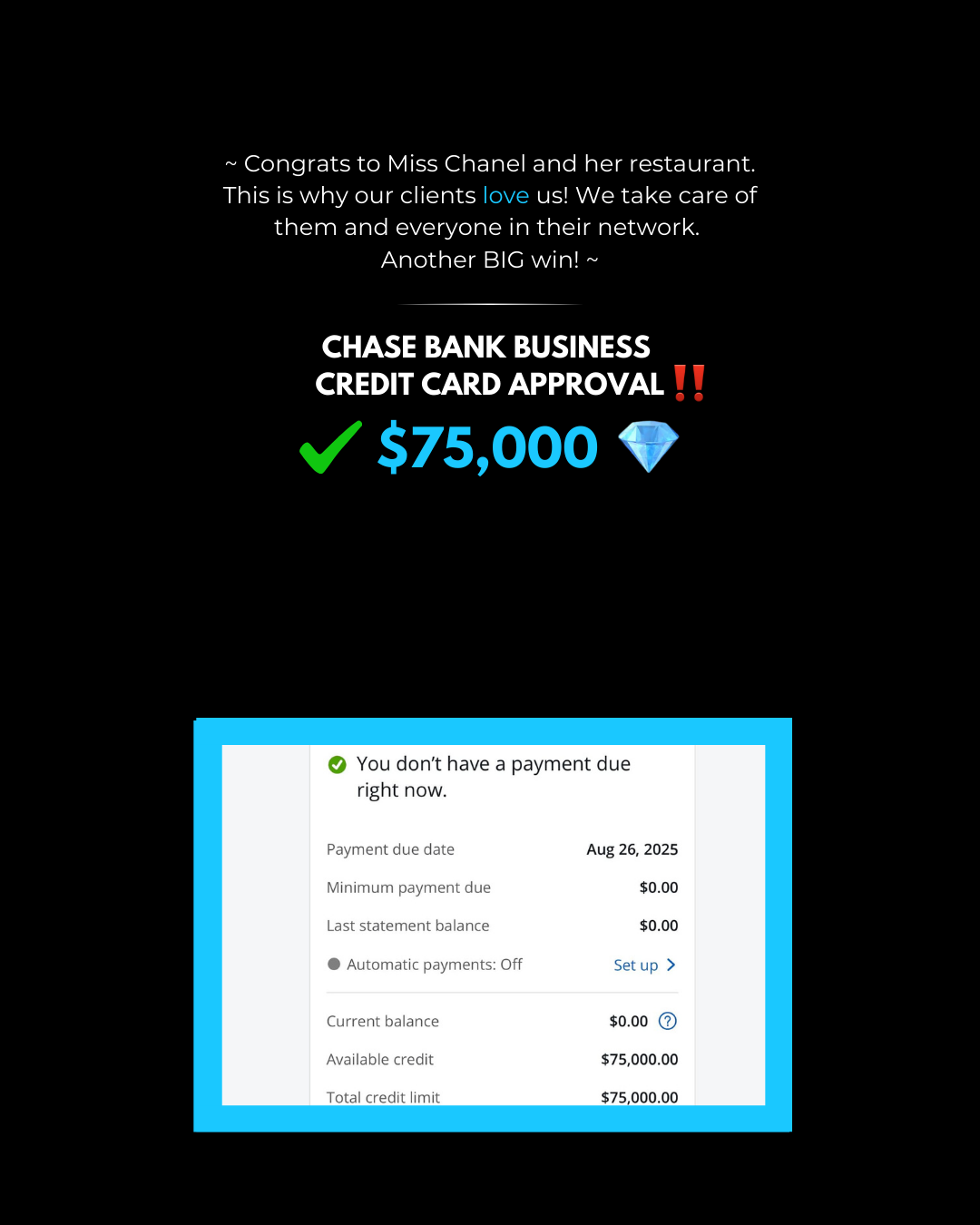

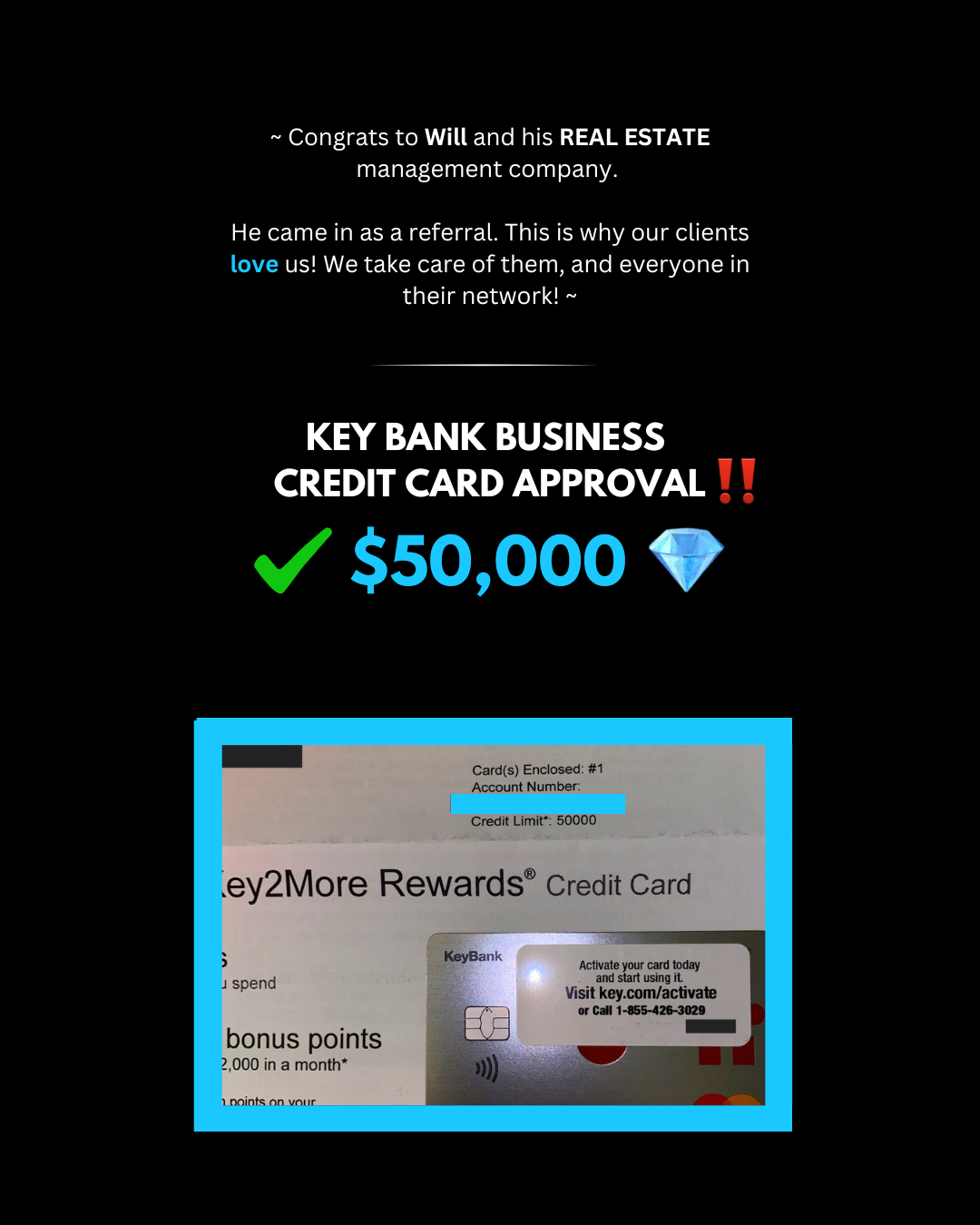

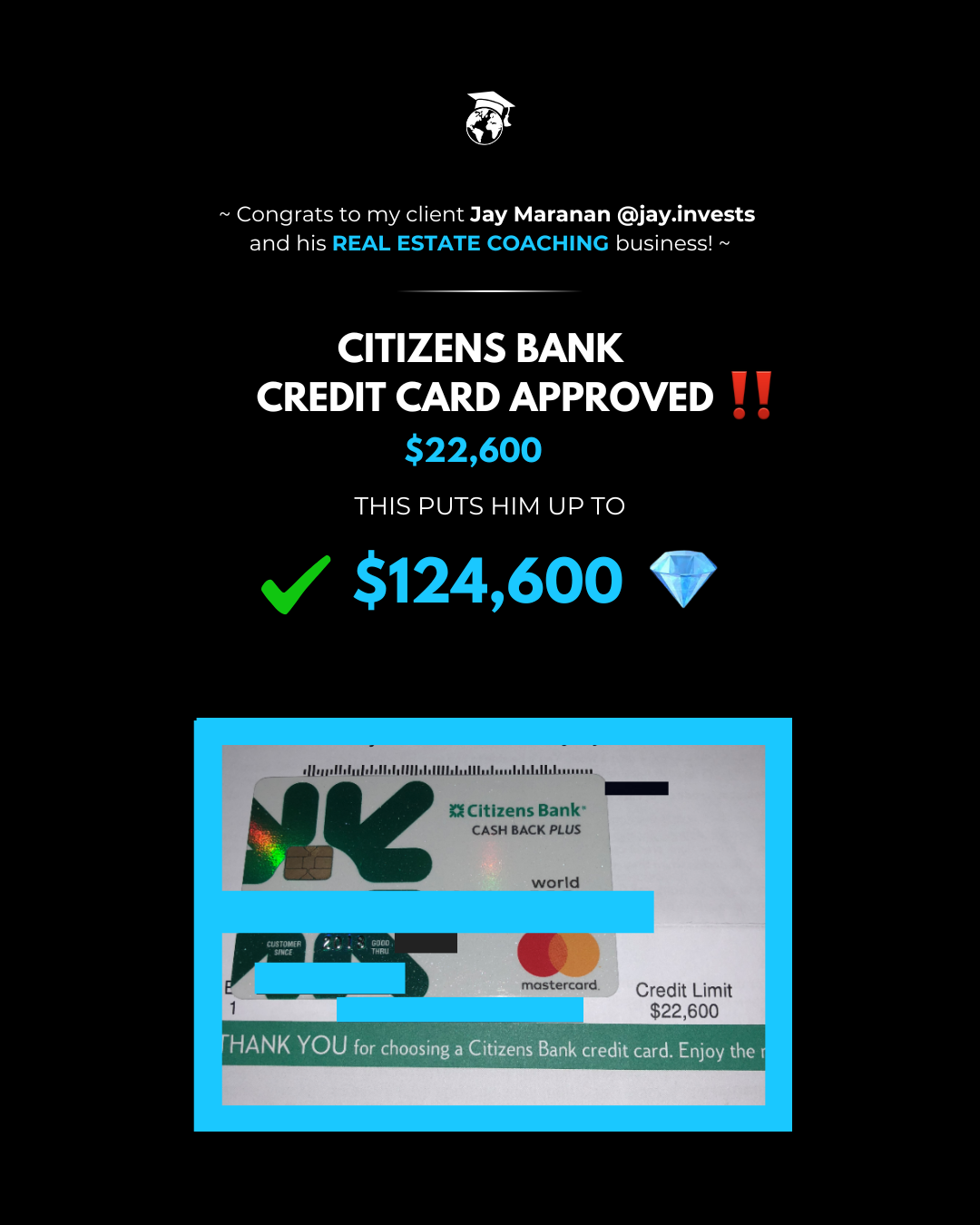

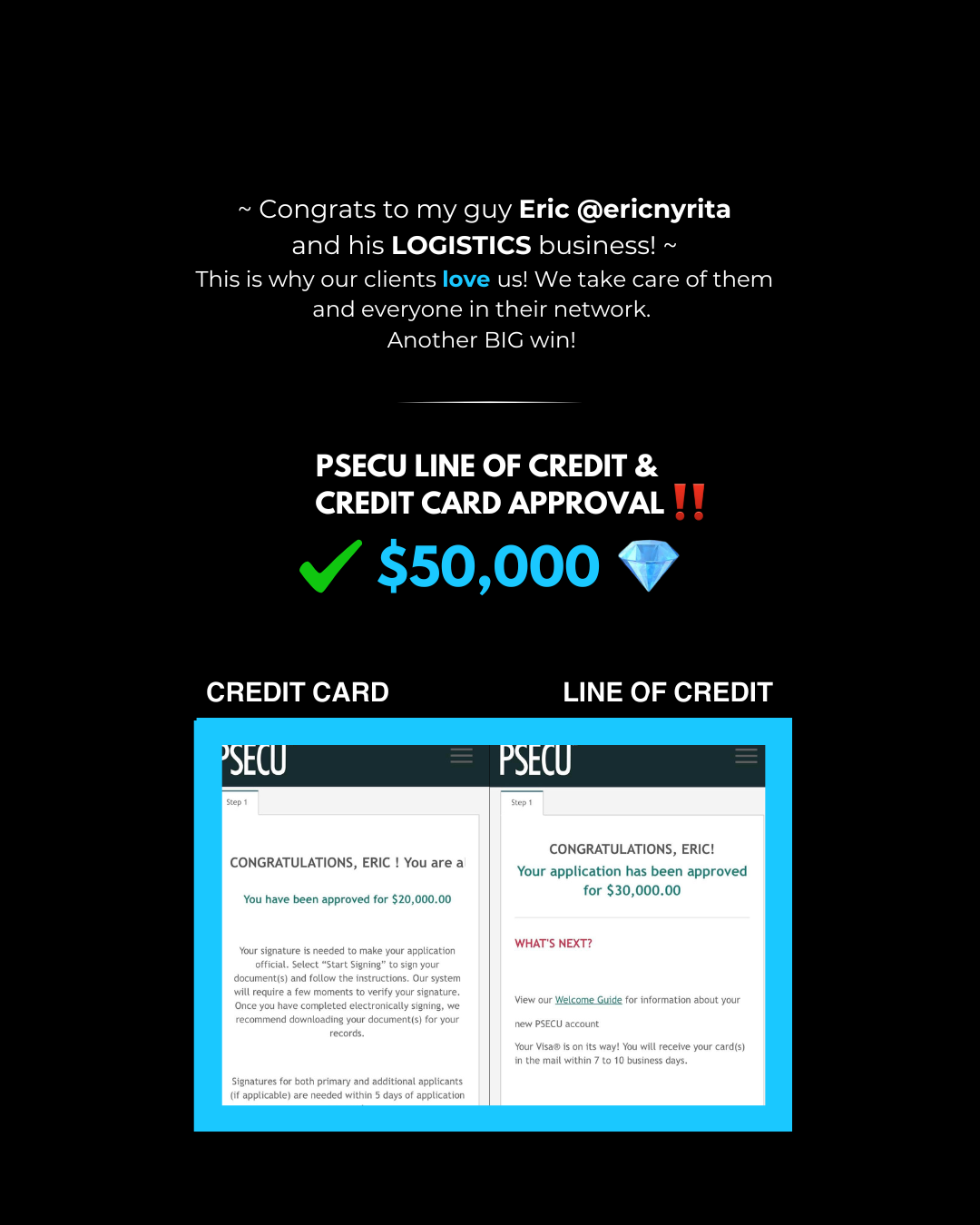

Funding Success Stories

Real clients, real funding results

Built for Growth-Minded Owners

Designed for owners who treat capital as a strategic advantage

Scaling Businesses

Business owners ready to take their operations to the next level with strategic capital deployment.

Real Estate Investors

Investors seeking capital for down payments, renovations, or portfolio expansion.

E-Commerce & Retail

Online and brick-and-mortar businesses needing inventory or marketing capital.

Secure the Capital Your Business Needs to Grow

Schedule a consultation to discuss your funding goals and qualification.